Fed’s Hawkish Stance: Why It Impacted Precious Metals

Last week was rough for precious metals. Gold, silver, platinum, and palladium all fell. Gold had the biggest weekly fall in about three years.

Oct. 12 2016, Published 8:36 a.m. ET

Biggest weekly slump

Last week was rough for precious metals and prices shredded the numbers. Gold, silver, platinum, and palladium all fell. Gold had the biggest weekly fall in about three years. Hawkish comments from many Fed officials ignited concerns about a sooner-than-expected interest rate rise. With the fall in the price, the open interest in gold also fell substantially.

The FOMC members’ speech on Friday was the critical factor that impacted these metals. Cleveland Fed President Loretta Mester mentioned that the increasing rates remain strong even after the US Department of Labor published a weaker-than-expected US payrolls report. Gold fell to the lowest level since Friday, but rebounded after that. Also, Fed Bank of Richmond President Jeffrey Lacker and Chicago Fed President Charles Evans made hawkish comments over the past week. Their comments signaled that higher rates are probably on the way.

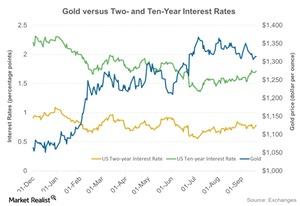

Precious metals get weak due to the rise in rates offered on Treasuries. The comparative performance of gold and the two and ten-year interest rate offered on Treasuries is shown in the above chart.

Funds and miners plummeted

Precious metals are non-yield bearing assets are impacted negatively by the rise in the yield. Precious metal funds like the PowerShares DB Gold Fund (DGL) and the Physical Swiss Gold Shares (SGOL) also suffered during the past week. They each fell 4.1% on a five-day trailing basis. The mining shares that have been the biggest losers over the past few days include Sibanye Gold (SBGL), Gold Fields (GFI), Agnico-Eagle Mines (AEM), and Silver Wheaton (SLW). These four companies rose 18.1%, 11.9%, 14.8%, and 13%, respectively. Together, these four miners contribute about 15.9% to the fluctuations in the VanEck Vectors Gold Miners Fund (GDX).