What Will Rising Crude Oil Inventories Mean for Crude Oil Movement?

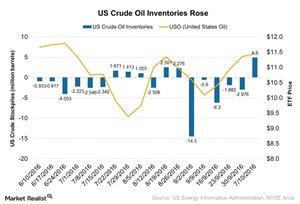

According to the Energy Information Administration report on October 12, US crude oil inventories rose by 4.9 MMbbls for the week ending October 7.

Oct. 17 2016, Published 12:40 p.m. ET

US crude oil inventories

According to the EIA’s (US Energy Information Administration) report on October 12, 2016, US crude oil inventories rose by 4.9 MMbbls (million barrels) for the week ending October 7, 2016. Markets expected a rise of 1.75 MMbbls, as compared to a drop of 2.976 MMbbls in the previous week. This rise for the week represents the first after four weeks of falling crude oil inventories.

Meanwhile, the United States Oil Fund (USO) fell 1.3%, and the ProShares Ultra Bloomberg Crude Oil ETF (UCO) fell 2.4% on October 12, 2016, after the announcement of the crude oil inventories report. Crude oil prices (USO) generally react positively to the fall in inventory level. The rise in inventories indicates that the supply glut position is increasing in the market, which will likely add more uncertainty to the movement of crude oil prices.

OPEC’s monthly production report

Crude oil prices touched a five-month high on October 5, 2016, after the announcement of the inventory report. OPEC’s (Organization of the Petroleum Exporting Counties) production cut decisions also supported the movement of crude oil (UWTI) (DWTI) (BNO) last week. OPEC also reported its monthly oil market report on Wednesday, October 12, showing that OPE crude oil production rose to an eight-year high in September 2016. The rise in crude oil inventories dragged down the movement of the crude oil (USO) (UCO).

Last week (ending October 14), we also saw the US Dollar Index rise to a six-month high. On October 12, the index was trading at 97.8, while the PowerShares DB US Dollar Bullish ETF (UUP), which tracks the performance of the US dollar index, rose 1.6% for the week. Remember, a stronger dollar not only affects the movement of commodity prices but also indicates that the market could be anticipating a higher probability of a rate hike by the Fed in December.

In the next part, we’ll analyze the performance of the US retail sales in September 2016.