The Airline Industry’s Cyclical Nature Is a Mixed Blessing

The airline industry is cyclical, which means that its business depends on the country’s economic growth. Most analysts have revised their GDP estimates downward, resulting in a consensus estimate of 2.9% YoY growth.

Sept. 26 2016, Published 11:47 a.m. ET

Why economic growth?

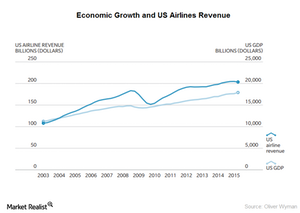

The airline industry is cyclical, which means that its business depends on the country’s economic growth. During periods of economic prosperity, disposable income is on the rise. A booming economy allows people to spend money on discretionary items such as air travel. So, airline revenues are higher during economic growth and lower during economic contraction.

Slow start in 2016

The economy started off 2016 at an extremely slow pace, recording year-over-year (or YoY) growth of 0.8% in the first quarter. Growth picked up slightly in 2Q16, recording 1.1% YoY growth.

However, this growth is still lower than what most economists expected. This is also lower than the historical average of more than 3% YoY and even worse than the 2.4% YoY average recorded in the last two years.

3Q16 GDP estimate cut

The August retail and housing stats already show a decline. According to the Commerce Department, retail sales fell 0.3% in August. Housing starts fell 5.8% YoY as compared to the estimated 1.7% decline. US industrial production also fell 0.4% in August, while retail inventories and US producer prices remained almost unchanged.

Most analysts, including Goldman Sachs and Morgan Stanley, have revised their GDP estimates downward. The consensus estimate now stands at 2.9% YoY growth.

The major US airlines include Delta Air Lines (DAL), American Airlines (AAL), United Continental (UAL), and Alaska Air Group (ALK). Investors can gain broad-based exposure to the airline industry by investing in the PowerShares Dynamic Leisure & Entertainment ETF (PEJ), which invests ~30% in airline stocks.