Understanding Oracle’s Value Proposition in the Software Space

Oracle was trading at a forward EV-to-EBITDA multiple of ~8.3x on December 8, 2016. This metric was lower than Microsoft’s multiple of ~10.3x.

Dec. 14 2016, Updated 9:35 a.m. ET

Oracle’s scale in the software space

So far in the series, we’ve discussed the market expectations from Oracle’s (ORCL) fiscal 2Q17 earnings as well as the company’s initiatives to make a mark in the cloud space and report top-line growth. We also learned of the various offerings that Amazon announced recently for AWS and what it means for players in the cloud space, especially for Oracle.

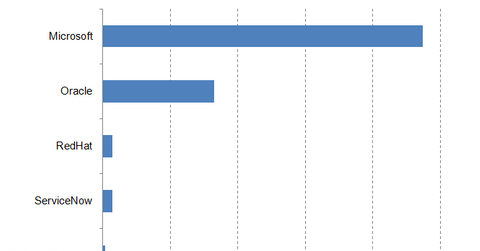

As of December 8, 2016, Microsoft (MSFT) continues to be the world’s largest software player by market capitalization, followed by Oracle, Red Hat (RHT), ServiceNow (NOW), and Tableau Software (DATA).

Oracle’s valuation multiples

Oracle was trading at a forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of ~8.3x on December 8, 2016. This metric was lower than Microsoft’s multiple of ~10.3x.

By comparison, Red Hat’s and ServiceNow’s multiples stood at ~18.3x and ~32.9x, respectively, as of the same date.

Oracle’s dividend yield

Oracle’s forward annual dividend yield was ~1.5% on December 8, 2016—lower than Microsoft’s forward dividend yield of ~2.6% on the same date. ServiceNow and Tableau Software don’t pay dividends.

Investors seeking application software exposure can consider investing in the PowerShares QQQ Trust, Series 1 ETF (QQQ). Notably, application software makes up ~28.4% of QQQ.

In the next and final part of this series, we’ll discuss analyst recommendations for Oracle’s stock.