How Danaher’s Business Segments Are Structured

Each segment of Danaher is made up of roughly about 50 independent operating companies that Danaher has acquired over the years.

Sept. 2 2016, Published 2:49 p.m. ET

Danaher’s business segments

This is the second series in our company overview of Danaher (DHR). In our first series, we analyzed Danaher’s history of returning excess returns over its cost of capital, and found it to be unimpressive. The company has recently realigned its business, with a spin-off of its industrial (IYJ) businesses into a new public company called Fortive (FTV). Therefore, we’ll look at the attractiveness of the individual business entities of a more focused Danaher in this series.

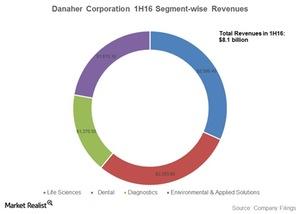

In its current form, Danaher retains four business segments. These segments are Life Sciences, Diagnostics, Dental, and Environmental & Applied Solutions. These segments represent approximately 22%, 33.5%, 19%, and 25%, respectively, of the company’s revenues in 2015. Before we dive deep into the details of that, let’s understand why Danaher was split in two.

Why was Danaher split into two parts?

Danaher decided to split into two independent companies after the acquisition of Pall in 2015. The company based its split on the need to create a more focused company with attractive characteristics and united by a common business model. Therefore almost all of its cyclical industrial (XLI) businesses went to Fortive and Danaher retained the defensive units, which had recurring revenues of about 60%.

How are Danaher’s segments structured?

Each of Danaher’s segments is made up of roughly about 50 independent operating companies that Danaher has acquired over the years. Companies within a single platform generally share common customers and have commercial synergies that Danaher benefits from. These businesses also have strong brands, a global reach, and dominant installed base, which brings in significant aftermarket revenues for Danaher. Among the companies in our coverage, Dover (DOV) is structurally similar to Danaher.