Stephens Reduces Flowers Foods’ Price Target to $14 per Share

Flowers Foods (FLO) has a market cap of $3.1 billion. It fell by 0.67% to close at $14.85 per share on August 12, 2016.

Nov. 20 2020, Updated 1:02 p.m. ET

Price movement

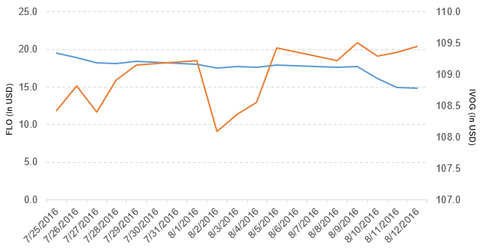

Flowers Foods (FLO) has a market cap of $3.1 billion. It fell by 0.67% to close at $14.85 per share on August 12, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -17.0%, -21.0%, and -29.7%, respectively, on the same day. FLO is trading 17.8% below its 20-day moving average, 18.7% below its 50-day moving average, and 24.3% below its 200-day moving average.

Related ETFs and peers

The Vanguard S&P Mid-Cap 400 Growth ETF (IVOG) invests 0.49% of its holdings in Flowers Foods. The ETF tracks a market-cap-weighted index of growth companies culled from the S&P 400. The YTD price movement of IVOG was 10.6% on August 12.

The SPDR S&P 400 Mid-Cap Growth ETF (MDYG) invests 0.49% of its holdings in Flowers Foods. The ETF tracks a market-cap-weighted index of growth companies culled from the S&P 400.

The market caps of Flowers Foods’ competitors are as follows:

Flowers Foods’ rating

Stephens has reduced the price target of Flowers Foods to $14 from $22 per share and maintained an “equal-weight” rating on the stock.

On August 11, 2016, Jefferies reduced Flowers Foods’ price target to $20 from $23 per share and maintained the “buy” rating on the stock. TheStreet Ratings rated the stock as a “buy” with a score of “B-.”

Latest news on Flowers Foods

Rosen Law Firm, Bronstein, Gewirtz & Grossman, Pomerantz LLP, Levi & Korsinsky, Glancy Prongay & Murray, Goldberg Law, and Lundin Law are investigating claims against Flowers Foods over possible violations of federal securities laws by the company and its officers and directors.

According to the press release on August 10, 2016, “the investigation concerns the Company’s August 10, 2016, disclosure that the U.S. Department of Labor has scheduled a compliance review of Flower Foods under the Fair Labor Standards Act.”

Performance of Flowers Foods in fiscal 2Q16

Flowers Foods reported fiscal 2Q16 sales of $935.0 million, a rise of 5.2% over the sales of $888.8 million in fiscal 2Q15, due to the acquisitions of Dave’s Killer Bread (DKB) and Alpine Valley Bread. Sales from direct-store-delivery and warehouse delivery rose by 4.5% and 9.1%, respectively, between fiscals 2Q15 and 2Q16.

It reported a pension plans settlement loss of $4.6 million in fiscal 2Q16. The company’s income from operations rose by 1.8% between fiscals 2Q15 and 2Q16.

Its net income fell to $51.2 million in fiscal 2Q16, compared with $51.8 million in fiscal 2Q15. It reported EPS (earnings per share) of $0.24 in fiscals 2Q15 and 2Q16. It reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) and adjusted EPS of $118.7 million and $0.26, respectively, in fiscal 2Q16. This was a rise of 5.2% and 4.0%, respectively, over fiscal 2Q15.

Projections

Flowers Foods has made the following projections for fiscal 2016:

- sales in the range of $3.93 million–$3.99 million

- EPS in the range of $0.88–$0.93

- adjusted EPS in the range of $0.90–$0.95

This projection considers increased competitiveness in the market and weak volumes. In the next part, we’ll discuss General Motors (GM).