Everything You Need to Know about the BITE ETF

To reap the rewards at both ends of the spectrum, a fund like the Restaurant ETF (BITE) could come in handy!

Sept. 1 2020, Updated 11:55 a.m. ET

A Fund Could Provide Balanced Exposure To the Restaurant Sector

Not all restaurant stocks are created equal. Shake Shack (SHAK) may be volatile due to its “trendy” nature – the restaurant’s January 2015 IPO is relatively recent – and focused, non-diversified menu; these very factors could provide significant rewards. On the other hand, McDonald’s (MCD) is likely to be steady with stable returns and a low propensity for wild fluctuations and rewards. To reap the rewards at both ends of the spectrum, a fund like the Restaurant ETF (BITE) could come in handy.

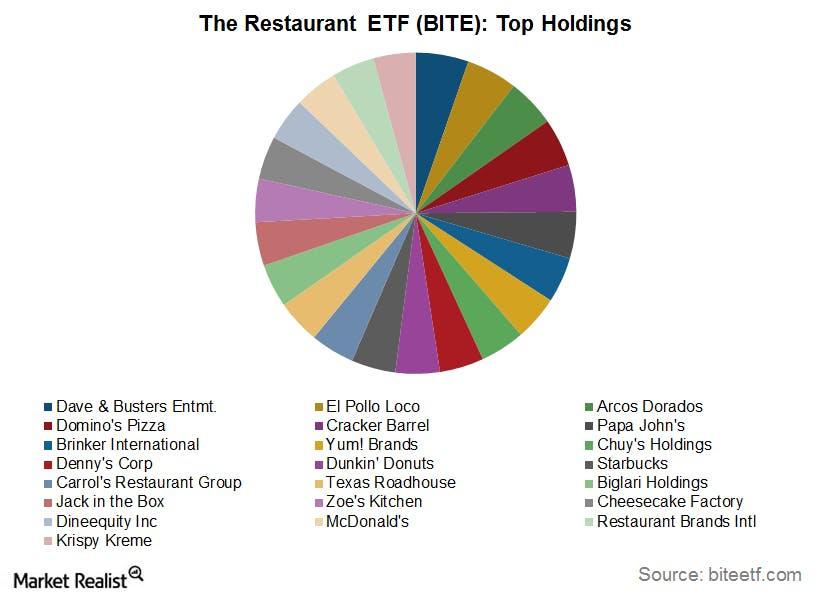

The BITE ETF aims to track the performance of the BITE index created by Big Tree Capital. The index comprises 45 US-listed restaurants with a market capitalization of at least $200 million and daily average turnover of $1 million. All the constituents have equal weights. Investors can capitalize on the opportunities provided by growth stories like Shake Shack (SHAK) and Chipotle Mexican Grill (CMG), while bigger names like McDonald’s and Starbucks (SBUX) provide stability and limit downside risk. All segments of the restaurant industry find representation in the ETF—from fast-casual options like Panera Bread Co. (PNRA), to fine dining like Ruth’s Chris Steak House (RUTH), to quick-casual like Restaurant Brand International’s Burger King (QSR) and casual dining establishments like Buffalo Wild Wings (BWLD).

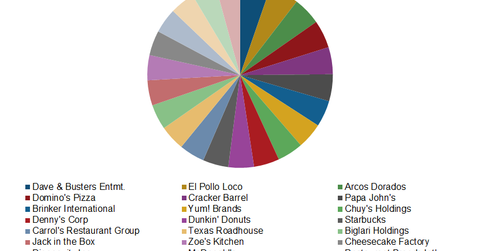

The graph above shows the top holdings for the Restaurant ETF (BITE). The top five holdings currently include Dave & Busters Entertainment (PLAY) at 2.9%, El Pollo Loco (LOCO) at 2.8%, Arcos Dorados (ARCO) at 2.7%, Domino’s Pizza (DPZ) at 2.7%, and Cracker Barrel Old Country Store (CBRL) at 2.6%.

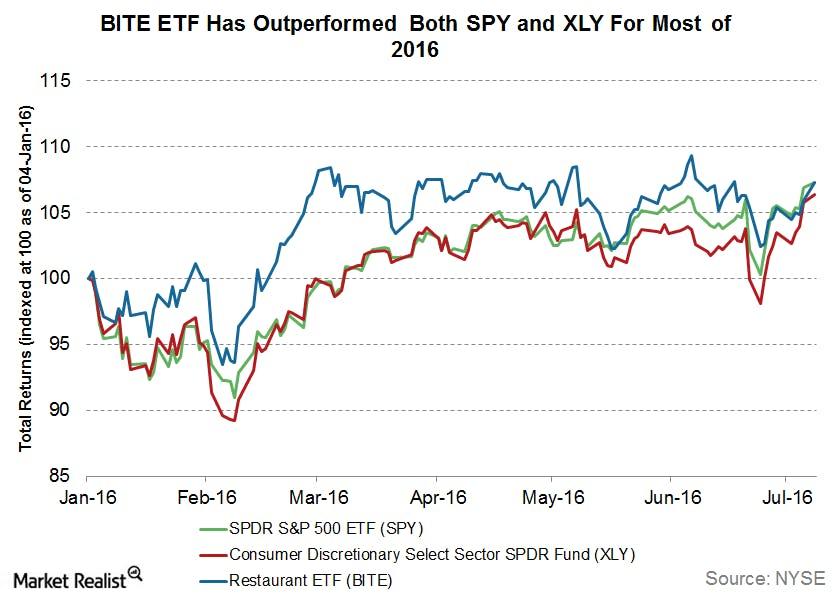

The ETF, which launched on October 28, 2015, is the first and only fund of its kind with exclusive coverage of the restaurant sector. The ETF currently holds 42 stocks and has an expense ratio of 0.75%. It has performed well in 2016, gaining 7.3% since the start of the year. The graph above shows the total returns of the Restaurant ETF, the SPDR S&P 500 ETF (SPY), and the Consumer Discretionary Select Sector SPDR Fund (XLY), indexed at 100 as of January 4, 2016. BITE has outperformed both XLY and SPY for most of the year.

With a solid backdrop for restaurant stocks in both the medium and long terms, there is a strong case for investors to consider the Restaurant ETF (BITE) as part of their portfolios. However, investors should remain cautious about the effect the Brexit vote could have on stocks like Starbucks, McDonald’s, and Yum! Brands, which all have exposure to European markets.