Hershey’s Returns, Including a 6% Dividend Hike, Hit a Sweet Spot

On July 28, 2016, Hershey (HSY) declared its 347th consecutive regular dividend on its common stock and 128th consecutive regular dividend on its Class B common stock.

Aug. 4 2016, Updated 11:04 a.m. ET

Hershey’s 347th consecutive regular dividend

On July 28, 2016, Hershey (HSY) declared its 347th consecutive regular dividend on its common stock and its 128th consecutive regular dividend on its Class B common stock. The company’s board of directors approved quarterly dividends of ~$0.62 on its common stock and ~$0.56 on its Class B common stock. That’s an increase of 6%. The dividend will be paid on September 15, 2016, to shareholders of record on August 25, 2016.

Returns to shareholders to date

Hershey paid $121 million to shareholders through dividends in 2Q16. The company also repurchased $117 million of outstanding shares. Of the $500 million authorization approved in January 2016, $100 million is remaining on this authorization. The company also repurchased $32 million of common shares to replace shares issued related to the exercise of stock options.

Hershey has a dividend yield of 2.2% as of July 29, 2016. Management has increased dividends at a CAGR (compound annual growth rate) of 12.5% over the last five years.

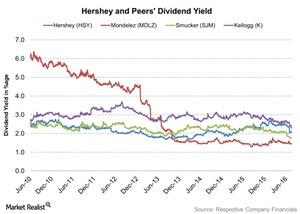

Peer dividend yield

Hershey’s peers in the snack foods industry include Mondelez (MDLZ), JM Smucker (SJM), and Kellogg (K). As of July 29, 2016, their dividend yields are as follows:

- Mondelez: 1.7%

- JM Smucker: 1.9%

- Kellogg: 2.4%

The iShares S&P Global Consumer Staples ETF (KXI) invests 0.44% of its portfolio in Hershey. The iShares Morningstar Mid-Cap (JKG) invests 0.95% of its holdings in Hershey.