Why Employment Numbers Are this Week’s Center of Attention

Strong non-farm employment required to maintain any rate hike hopes Non-farm employment changes are one of the most important indicators the US Fed considers in deciding on monetary policy. May non-farm employment changes hit a multi-year low, which took away all probabilities of a June hike. Check out the following article for further detail on May’s […]

Nov. 20 2020, Updated 3:06 p.m. ET

Strong non-farm employment required to maintain any rate hike hopes

Non-farm employment changes are one of the most important indicators the US Fed considers in deciding on monetary policy. May non-farm employment changes hit a multi-year low, which took away all probabilities of a June hike. Check out the following article for further detail on May’s employment report: Unemployment Falls to 8-Year Low as People Leave the Workforce.

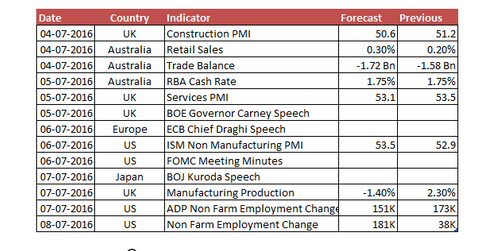

The June release is scheduled for July 8, with the markets expecting a modest bounce back as forecasts suggest a rise of 181,000 jobs.

The busy week also has the ISM non-manufacturing PMI[1. purchasing managers’ index] and FOMC minutes scheduled for July 6.

European data in the week ahead

Looking at the UK data scheduled for release this week, we can expect a speech by Bank of England Governor Carney on July 6 to give further direction to the markets. UK (FKU) manufacturing production is expected to fall 1.4% with the data release scheduled for July 7. European Central Bank Chief Mario Draghi is expected to try to reassure the markets that Europe (DBEU) is well prepared for the Brexit through his speech at the ECB Statistics conference in Frankfurt on July 6.

RBA to ponder a rate cut

The Reserve Bank of Australia (or RBA) has scheduled a monetary policy review for July 5. The RBA is expected to keep its cash rate unchanged at 1.75%. But it might be forced to act if the preceding data releases in the form of retail sales and the trade balance fall below forecasts. Australian (EWA) retail sales are expected to rise to 0.3%. The Australian (VPL) trade deficit is expected to fall to 1.7 billion.

In the next part of this series, we’ll cover building permits data, which fell below forecasts.