Why US Crude Oil Inventories Fell for 9th Consecutive Week

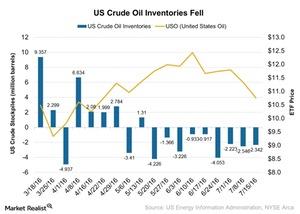

According to the July 20, 2016, U.S. Energy Information Administration report, US crude oil inventories declined by 2.3 MMbbls for the week ended July 15, 2016.

July 26 2016, Published 12:35 p.m. ET

US crude oil inventories

According to the U.S. Energy Information Administration’s report on July 20, 2016, US crude oil inventories declined by 2.3 MMbbls (million barrels) for the week ended July 15, 2016. That compares to a decline of 2.6 MMbbls in the previous week. The Market expected a decline of 2.1 MMbbls. It beat Market expectations but declined for the ninth consecutive week.

The United States Oil ETF (USO) rose 0.28%, and the ProShares Ultra Bloomberg Crude Oil ETF (UCO) rose 0.12% on July 20, 2016, as inventory reports meet Market expectations.

What does it indicate for crude oil prices?

The consecutive fall in crude oil inventories is a good sign for crude oil prices. In the past nine weeks, we saw that crude oil inventories fell. According to many traders, it’s a seasonal effect.

Traders were expecting a large draw on oil inventories in the summer driving season. Crude oil (UWTI) (BNO) prices now slowly started falling. But falling crude oil inventories aren’t allowing a huge fall in crude oil prices.

The stronger US dollar (UUP) could hamper the movements of crude oil, as commodity prices are dollar-denominated assets. If the Federal Reserve hikes interest rates in its next monetary policy meeting, it may harm the movements of crude oil.

In the next part of this series, we’ll analyze the Flash Services PMI (Purchasing Managers’ Index) for France.