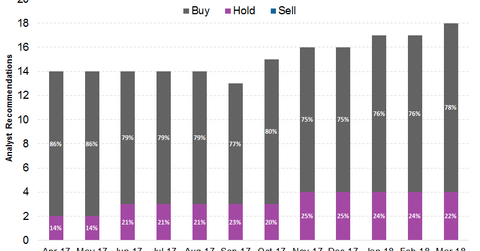

Cheniere Energy: What Analysts Recommend

Currently, 78% of the analysts surveyed by Reuters rate Cheniere Energy as a “buy” as of March 22, 2018, while the remaining 22% rate it as a “hold.”

Nov. 20 2020, Updated 5:29 p.m. ET

Analysts’ ratings for Cheniere Energy

Recently, Bank of America initiated coverage on Cheniere Energy (LNG) with a “buy” rating. Stifel Nicolaus initiated coverage with a “buy” rating, while Barclays increased Cheniere Energy’s target price to $62 from $58 following its strong 4Q17 earnings.

Currently, 78% of the analysts surveyed by Reuters rate Cheniere Energy as a “buy” as of March 22, 2018, while the remaining 22% rate it as a “hold.”

Cheniere Energy Partners (CQP) and Cheniere Energy Partners LP Holdings (CQH) have “hold” ratings from 56.3% and 63.6% of the analysts, respectively. Cheniere Energy is trading below the low range ($55) of analysts’ target price. Cheniere Energy’s average target price of $63.9 implies a massive ~23% upside potential from the current price levels.

For more coverage on midstream companies, visit Market Realist’s Master Limited Partnerships page.