Soros Fund Management opens a new position in Marathon Petroleum

George Soros’ Soros Fund Management added a new position in Marathon Petroleum (MPC) that accounts for 0.45% of the fund’s 1Q 2014 portfolio.

May 20 2014, Published 9:00 a.m. ET

Soros Fund Management and Marathon Petroleum

Soros Fund Management added new positions in Baker Hughes Inc. (BHI), RF Micro Devices Inc. (RFMD), Devon Energy (DVN), Spansion Inc. (CODE), and Marathon Petroleum (MPC) in 1Q14. The top positions it sold include J.P. Morgan Chase & Co. (JPM), Citigroup (C), and J.C. Penney (JCP).

George Soros’ Soros Fund Management added a new position in Marathon Petroleum (MPC) that accounts for 0.45% of the fund’s 1Q 2014 portfolio.

Marathon Petroleum is the nation’s fourth-largest refiner, with a crude oil refining capacity of approximately 1.7 million barrels per calendar day in its seven-refinery system. Marathon-brand gasoline sells through approximately 5,200 independently owned retail outlets across 18 states. Plus, Speedway LLC, an MPC subsidiary, owns and operates the nation’s fourth-largest convenience store chain, with approximately 1,480 convenience stores in nine states. Marathon owns, leases, or has ownership interests in approximately 8,300 miles of crude oil and products pipelines. Through ownership interests in MPLX and Pipe Line Holdings, Marathon is one of the largest petroleum pipeline companies in the United States on the basis of total volume delivered. Its refineries supply refined products to resellers and consumers within its market areas, including the Midwest, Gulf Coast, and Southeast regions of the United States. The company has three reportable operating segments: Refining & Marketing, Speedway, and Pipeline Transportation.

Marathon Petroleum, which spun off from Marathon Oil Corporation (MRO), has a master limited partnership named MPLX LP that owns, operates, develops, and acquires pipelines and other midstream assets related to the transportation and storage of crude oil, refined products, and other hydrocarbon-based products. The MPLX investment provides MPC an efficient vehicle to invest in organic projects and pursue acquisitions of midstream assets.

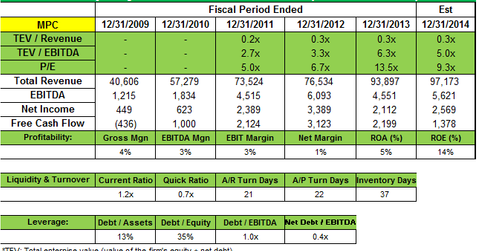

Marathon’s 1Q 2014 results missed on earnings but beat on revenue. Net income declined to $199 million, or $0.67 per diluted share, for the first quarter of 2014 from $725 million, or $2.17 per diluted share, for the first quarter of 2013. The decrease was primarily due to the Refining & Marketing segment, which was impacted by narrower crude oil differentials and higher turnaround costs. The Speedway segment’s income from operations decreased to $58 million in the first quarter of 2014 from $67 million in the first quarter of 2013 due to severe weather conditions in the Midwest. Pipeline Transportation segment income from operations, including 100% of MPLX LP’s operations, increased to $72 million in the first quarter of 2014 from $51 million for the first quarter of 2013 due to an increase in pipeline transportation revenue and equity affiliate income.

The company also saw major turnarounds completed at its two largest refineries, Galveston Bay and Garyville. Plus, Marathon said, “Adverse weather conditions throughout the quarter created a challenging work environment across our integrated operations.” Management commented, “Despite the challenging market conditions in our Refining & Marketing segment, we returned $812 million of capital to shareholders through dividends and share repurchases in the quarter.”