Alcoa’s Downstream Business Is Thriving: What about Upstream?

Alcoa’s upstream business has been gaining strength. It also has a downstream business, which produces alumina and primary aluminum.

Dec. 23 2015, Updated 11:44 a.m. ET

Alcoa’s upstream business

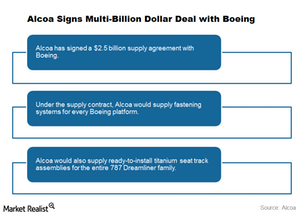

Alcoa (AA) has signed a long-term supply contract with Boeing (BA) valued at over $2.5 billion. Under the deal, Alcoa will supply fastening systems for every Boeing platform. According to Alcoa, it’s the largest fastener deal for the company.

Precision Castparts (PCP), which will be acquired by Berkshire Hathaway (BRK-B), is another leading fastener supplier to the aerospace sector. Currently, PCP forms 1.8% of the Industrial Select Sector SPDR ETF (XLI).

Under the deal with Boeing, Alcoa will also “supply ready-to-install titanium seat track assemblies for the entire 787 Dreamliner family.” It’s important to note that Alcoa’s titanium portfolio has strengthened following its acquisition of RTI Metals.

Another multi-billion dollar deal

Alcoa’s contract with Boeing is another multi-billion dollar deal that it has signed over the last one year. In October, Alcoa signed multi-year supply contracts with Airbus and Lockheed Martin. Both these contracts were valued in excess of $1 billion. Furthermore, last year, Alcoa signed multi-year contracts with Boeing and Pratt & Whitney. The combined value of these contracts was more than $2 billion.

Aerospace bet

Alcoa’s bet on lightweighting seems to be working, as is visible in these multi-billion dollar contracts. As Alcoa’s chairman and chief executive officer Klaus Kleinfeld said in his statement following the deal announcement, “Alcoa has positioned itself to win in a multi-material aerospace industry, and these deals are the latest proof points that our strategy is working.”

Alcoa’s downstream business has been gaining strength following strong aerospace demand. Strong auto sheet demand is also working to Alcoa’s advantage. However, Alcoa also has a upstream business which produces alumina and primary aluminum. Alcoa investors should also track how the company’s upstream business is doing.

In this series, we’ll explore how Alcoa’s upstream business has been doing in December.