How Did Barnes & Noble Perform Compared to Its Competitors?

Barnes and Noble’s price-to-book value ratio is 0.63. Based on its price movement and PBV ratio, Barnes & Noble is performing well behind its ETFs.

Nov. 20 2020, Updated 1:06 p.m. ET

ETFs that invest in Barnes & Noble

The PowerShares S&P SmallCap Consumer Discretionary Portfolio ETF (PSCD) invests 0.99% of its holdings in Barnes & Noble. This ETF tracks a cap-weighted index of consumer staples stocks selected from the S&P SmallCap 600.

The RevenueShares Small Cap ETF (RWJ) invests 0.98% of its holdings in Barnes & Noble. This ETF tracks an index of S&P SmallCap 600 Index stocks that are weighted by revenue.

The SPDR S&P Retail ETF (XRT) invests 0.93% of its holdings in Barnes & Noble. The ETF tracks a broad-based, equal-weighted index of stocks in the US retail industry.

The Workplace Equality Portfolio ETF (EQLT) invests 0.57% of its holdings in Barnes & Noble. This ETF tracks an index of about 140 global stocks selected by the firms’ support of lesbian, gay, bisexual, and transgender employees in the workplace. These stocks are equally weighted.

Comparison of Barnes & Noble with its ETFs

The year-to-date price movement of Barnes & Noble Inc. (BKS), the PowerShares S&P SmallCap Consumer Discretionary Portfolio ETF (PSCD), the RevenueShares Small Cap ETF (RWJ), and the SPDR S&P Retail ETF (XRT) is -21.80%, 1.48%, -6.12%, and -1.46%, respectively.

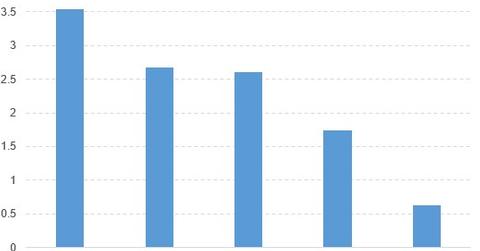

Barnes and Noble’s price-to-book value (or PBV) ratio is 0.63. The PowerShares S&P SmallCap Consumer Discretionary Portfolio ETF (PSCD), the RevenueShares Small Cap ETF (RWJ), the SPDR S&P Retail ETF (XRT), and the Workplace Equality Portfolio (EQLT) have PB ratios of 2.67x, 1.74x, 3.54x, and 2.61x, respectively.

Based on its price movement and PBV ratio, Barnes & Noble is performing well behind its ETFs.

Comparison of Barnes & Noble with its peers

Barnes & Noble’s current ratio in 1Q16 is 1.21, which is similar to its competitors: Amazon.com (AMZN) at 1.10, Nebraska Book Holdings (NEEB)(NEEB) at 1.25, and Chegg Inc. (CHGG) at 2.09.

In 1Q16, the gross profit margins of Barnes & Noble (BKS), Books-A-Million (BAMM), Chegg Inc. (CHGG), Amazon.com (AMZN), and Nebraska Book Holdings (NEEB)(NEEB) are 28.9%, 27.88%, 45.94%, 34.61%, and 50.03%, respectively. Based on gross profit margin figures, these competitors have outperformed Barnes & Noble.