Analyzing the EV-to-Reserves Ratio for Tracking Miners

The EV-to-reserves ratio is good for the mining industry. “Enterprise value” reflects the company’s total value. “Reserves” refers to geologic reserves that the business owns.

Sept. 23 2015, Updated 8:37 a.m. ET

EV-to-reserves ratio

When evaluating companies in the mining business, a generic ratio comparison like the PE (price-to-earnings) ratio, the price-to-sales ratio, and the PBV (price-to-book value) ratio isn’t as useful. The mining business is capital-intensive. This leads to likely distorted tax structures, non-cash items, and capital structures.

Instead, a better performance tracker is the EV-to-reserves (enterprise value-to-reserves) ratio. “Enterprise value” reflects the company’s total value. “Reserves” refer to geologic reserves that the business owns. In layman’s terms, it helps investors compare the total value of the mining business with respect to the gold reserves. Sometimes, it includes the resources that the company owns. In the case of gold miners, the enterprise value per ounce of gold reserves is a superior measure because it highlights how much investors are paying for a gold miner’s core assets—its gold reserves.

The lower the better

As with the other significant price ratios, a lower EV-to-reserves ratio is better. It determines the amount the investors are spending out of their pockets per ounce to pay for the gold reserve. The gold reserves are determined by the current gold prices. As a result, falling prices can be troublesome for the miners. A lower ratio likely indicates undervaluation. In contrast, a higher ratio may indicate overvaluation.

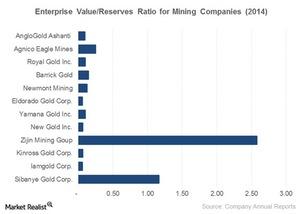

With gold prices close to $1,100 per ounce, the AISC (all-in sustaining cash) costs that we saw earlier in this series are squeezing the miners’ margins to severe levels. The above chart compares the EV-to-reserves ratio for different miners around the globe.

Highest and lowest

Zijin Mining is the largest gold producer in China. It has the highest EV-to-reserves ratio. The company’s high figure shows its likely overvaluation in terms of the gold reserves it owns. The EV-to-reserves ratio for Zijin is 2.58. Also, Sibanye Gold (SBGL) is a South Africa-based miner. It has a ratio of about 1.17. This is high compared to the other miners.

Among the best miners with the lowest EV-to-reserves ratio are Kinross Gold (KGC), Iamgold (IAG), and Eldorado Gold (EGO). These companies have a ratio that’s close to 0.06. Together, they account for 10.30% of the VanEck Vectors Gold Miners ETF (GDX).

Gold ETFs like iShares Gold Trust (IAU) also fell as much as gold on a YTD (year-to-date) basis.