Why TJX Companies Commands a Higher Valuation than Its Peers Do

As of August 24, TJX Companies stock was trading at $69.43, a rise of 2.2% since the start of 2015. The company’s stock price rose 7.2% on August 18, the day it announced its 2Q16 results.

Dec. 4 2020, Updated 10:53 a.m. ET

Stock price movement

As of August 24, TJX Companies stock was trading at $69.43, a rise of 2.2% since the start of 2015. The company’s stock price rose 7.2% on August 18, the day it announced its 2Q16 results. A decline in more recent days was triggered by weakness in the broad market caused by global uncertainty.

Ross Stores (ROST) stock has risen 3.1%, and Burlington Stores (BURL) has fallen 0.1% since the beginning of 2015.

The Consumer Discretionary Select Sector SPDR Fund (XLY) has fallen 0.3% since the beginning of this year. The SPDR S&P 500 ETF Trust (SPY) fell 7.8% over the same period. TJX Companies constitutes 2.2% of the portfolio holdings of XLY and 0.3% of SPY.

Valuation compared to peers

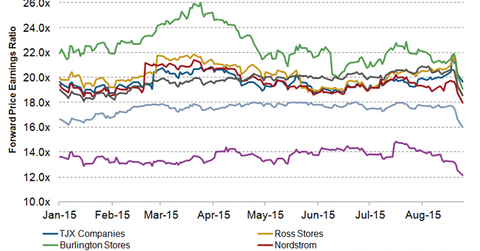

As of August 24, TJX Companies was trading at a forward PE (price-to-earnings ratio) of 19.7x. The company’s forward PE increased by 6.8% following the announcement of its second-quarter results on August 18. As discussed in Parts 1 and 2 of this series, the company delivered sales and earnings beats in 2Q16. Overall, the company’s adjusted EPS (earnings per share) increased by 7.2% to $1.49 in the first half of fiscal 2016.

Major players in the off-price retail space, Ross Stores and Burlington Stores, have forward PEs of 18.6x and 19.1x, respectively. TJX Companies’ valuation and those of other off-price peers are higher than department store valuations. Nordstrom (JWN) and Macy’s (M) are trading at forward PEs of 17.9x and 12.2x, respectively. All of the aforementioned valuations were effective as of August 24.

The premium valuations of the off-price stores are justified by their strong sales growth and better prospects compared to their department store cohorts. TJX Companies’ higher valuation also reflects the upward revision to its fiscal 2016 guidance, as discussed in Part 6 of this series.

Competition heating up

The competition in the off-price space is getting intense. Nordstrom is aggressively expanding its off-price Rack stores. And Macy’s is on track to launch Macy’s Backstage off-price stores in fall 2015. Nevertheless, TJX Companies’ vast presence in off-price retailing in the US, Canada, and Europe, its strong business model, and its impressive supplier relations make it a tough player to compete with.

For more updates and analysis, visit our Consumer and Retail page.