3-Year Treasury Notes’ Overall Demand Fell on July 7

The US Treasury holds monthly auctions of three-year Treasury notes. The latest auction was held on July 7.

Dec. 4 2020, Updated 10:53 a.m. ET

Three-year Treasury notes

The US Treasury holds monthly auctions of three-year Treasury notes (or T-Notes). The yield on the three-year T-Notes relates to movements in the federal funds rate. So it attracts a lot of attention from stock and bond market participants.

MFS Government Securities A (MFGSX) invests in three-year T-Notes. The fund has a modified duration of 4.8 years and provided a week-over-week return of 0.22%

Of Prudential Government Income A’s (PGVAX) holdings, 50% are in the maturity range of three to five years. Its week-over-week return came in at 0.33%.

Key takeaways

- The auction was held on July 7.

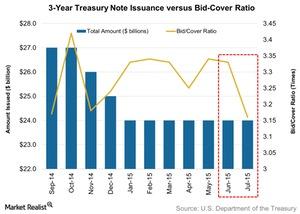

- The auction size was set at $24 billion—unchanged from the December 2014 auction.

- The coupon rate stood at 0.875%—25 basis points lower than the June auction.

- The high yield for July’s auction was lower, at 0.932% compared to 1.125% in June.

- The bid-to-cover ratio dropped by 5% to 3.16x in July, which implies lower overall demand for the auction. It’s calculated as the total value of bids received divided by the value of securities on offer.

Yield analysis

The yield on three-year T-notes grew marginally by 1 basis point in the secondary market after the auction. It ended at 0.96% on July 7 compared to 0.95% on the previous day.

Demand analysis

There was a small rise in month-over-month market demand. Total competitive bids came in at 61.6% compared to 60.4% in the previous month. Indirect bids fell from 50.7% in June to 47.7% in July. Indirect bidders include foreign central banks. Meanwhile, direct bids accounted for 13.9%—up from 9.7% in June. Direct bidders include money managers like Wells Fargo (WFC) and Invesco (IVZ).

Due to a rise in market demand, the share of primary dealers fell to 38.4% from 39.6% a month ago. Primary dealers include companies like JPMorgan Chase & Co. (JPM).

From the next article of this series onwards, we’ll look at the Treasury bills auction.