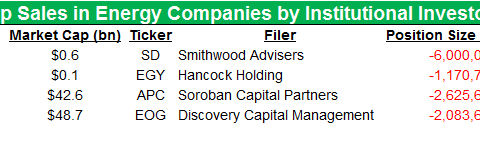

Smithwood Advisers and Hancock Sell Stakes in Energy in 1Q15

Smithwood Advisers was among the hedge funds that sold their stakes in SandRidge Energy in 1Q15. Hancock Holding was one of the firms that sold stakes in Vaalco Energy.

Nov. 20 2020, Updated 3:41 p.m. ET

Hedge fund holdings in Vaalco and SandRidge take a nosedive

The number of aggregate shares held by various hedge funds in Vaalco Energy (EGY) and SandRidge Energy (SD) fell by ~10%, according to 13F data for 1Q15. Fewer than ten filers held these stocks in their top ten holdings.

Smithwood Advisers was among the hedge funds that sold their stakes in SandRidge Energy in 1Q15. Hancock Holding Company sold its stake in Vaalco Energy. Going along with the prevailing trend, more funds lowered their exposures to oil and gas exploration and production companies than added to or increased their exposures to these companies.

As you can see in the above table, hedge funds have also lowered their holdings in large-cap energy companies such as Anadarko Petroleum Corporation (APC) and EOG Resources (EOG). But there seems to be a preference for large-cap energy stocks.

The PowerShares S&P SmallCap Energy ETF (PSCE) shows this trend as well. The number of funds selling off this small-cap energy portfolio increased, while funds buying it decreased. We can compare this to the Energy Select Sector SPDR ETF (XLE) in which the number of new funds buying more than doubled from 4Q14 to 1Q15 and sell-offs decreased slightly.

Reversal in hedge fund trades since the beginning of 2Q15

As you can see in the above graph, sell-offs in PSCE significantly decreased from 4Q14 to 1Q15.

On the other hand, there has been a stable trend in sell-offs of XLE along with a declining trend in new purchases of large-cap energy stocks.

In the next part of this series, we’ll take a look at the impact of the dollar and concerns over the supply of oil and the impact on long-term trends in oil.