New Charter’s Footprint: Better Position to Reach Customers

New Charter is the proposed merged entity. The company will include networks of some of the largest cable operators in the US.

June 1 2015, Published 8:31 a.m. ET

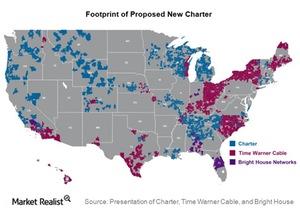

New Charter’s footprint

In the last part of the series, we learned about the proposed Charter (CHTR), Time Warner Cable (TWC), and Bright House merger. The merger was announced on May 26, 2015. In this part of the series, we’ll look at New Charter’s footprint. New Charter is the proposed merged entity. The company will include networks of some of the largest cable operators in the US.

Time Warner Cable is the second largest cable operator in the US. The largest cable operator is Comcast (CMCSA). According to the merger press release, among the largest cable companies New Charter ranks fourth and Bright House ranks sixth. The combined entity will have service availability in 48 million households. Also, New Charter will have a significant 24 million customers. Together, the three cable companies will cover nine DMAs (designated market areas) in the top 25. Bright House brings two DMAs—Tampa and Orlando—to the proposed company. Both Tampa and Orlando are among the top 20 DMAs.

Better positioning to tap customers

The proposed merged entity will have a vast geographical reach. It should benefit from a branding perspective in both the residential and business segments. According to Charter, New Charter’s large domestic coverage and scale should help the company target medium and large enterprises. Telecommunication companies still dominate this segment with their broad coverage and significant service portfolios in the wireless and wireline segments.

However, cable companies have started making inroads in footprints of telecommunications companies, mainly in small and medium businesses. A large coverage may give New Charter the flexibility to cater to the needs of companies operating from multiple locations.

If you want to get diversified exposure to Time Warner Cable, you could invest in the Consumer Discretionary Select Sector SPDR Fund (XLY). XLY held ~1.9% in Time Warner Cable on April 30, 2015.

You could also consider investing in the iShares Core S&P 500 ETF (IVV). IVV held ~0.2% in the cable company on the same date.