Nordstrom’s operating margins feel the squeeze from expansion

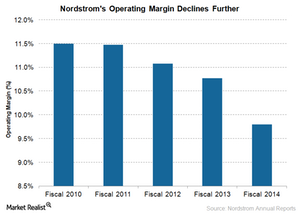

In fiscal 2014, Nordstrom’s operating margins declined by another 9.8% on the heels of a 10.8% decline in fiscal 2013.

Dec. 4 2020, Updated 10:53 a.m. ET

Growth initiatives impact margins

Recently, Nordstrom (JWN) has invested in expanding its business, particularly its outlets and off-price stores. The company is also investing in technology to support its e-commerce business and enhance its customers’ shopping experience. The downside is that these growth initiatives are having an adverse impact on Nordstrom’s operating margins.

Fiscal 2014 margins decline

In fiscal 2014, Nordstrom’s operating margins declined by another 9.8% on the heels of a 10.8% decline in fiscal 2013. The company’s selling, general, and administrative expenses, as a percentage of net sales, increased 42 basis points to 28.8% compared to last year. Expenses associated with the Trunk Club acquisition, technology upgrades, and investments in fulfillment centers are largely responsible for these expenses. Margins were also impacted by higher markdowns at the Rack stores. Even in 4Q14, the company’s margins declined to 11.5% compared to 13.1% in the same quarter a year ago.

Competing margins

In fiscal 2014, Nordstrom’s operating margins were better than Dillard’s (DDS) and Kohl’s (KSS). Yet the company’s margins were lower than Macy’s (M) and leading off-price player TJX Companies (TJX). These companies reported margins of 9.9% and 12.2%, respectively.

The Consumer Discretionary Select Sector SPDR Fund (XLY) and the First Trust Consumer Discretionary AlphaDEX Fund (FXD) have 6.12% and 9.20% exposure, respectively, to multi-line retailers such as Nordstrom and its competitors.

Near-term margins

Nordstrom’s plans to increase the Rack store count, remodel existing stores, and improve online infrastructure will continue to impact its operating margins. The company expects depreciation and rent expenses to increase by 20%. Selling, general, and administrative expenses are anticipated to increase by 55 to 65 basis points in fiscal 2015.

The next part of this series looks at the company’s capital expenditures that are supporting its growth strategy.