EIA Crude Oil Inventory Report: Essentials for Energy Investors

Crude oil inventory levels change based on demand and supply trends. Demand comes primarily from refineries that process this crude into refined products.

March 31 2015, Published 2:44 p.m. ET

EIA inventory data

The EIA (US Energy Information Administration) usually reports weekly figures on crude oil inventories every Wednesday. The report also includes data on distillate and gasoline inventories. Distillates and gasoline are refined crude oil products.

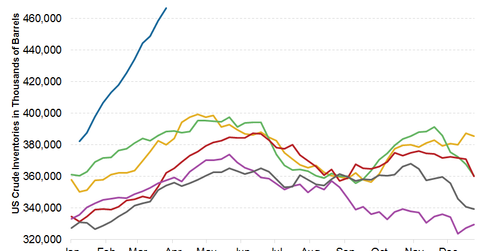

Crude oil inventory levels change based on demand and supply trends. Demand comes primarily from refineries that process this crude into refined products—like gasoline and heating oil. Supply comes from domestic production and imports from other countries.

Inventories increase when demand is lower and decrease when demand is higher than supplies for the week. Every week, analysts anticipate an increase or decrease in crude inventories based on demand and supply expectations in that week.

Analysts expected an increase of ~4.75 million barrels, or MMbbls, in crude inventories last week. We’ll discuss the actual changes in inventories later in this series.

Price and profitability

The difference between actual and expected changes in inventories affects crude prices. We’ll cover recent crude oil price movements in a later part of this series. Crude oil prices directly affect major oil producers’ earnings—like Concho Resources (CXO), Whiting Petroleum (WLL), Chevron (CVX), and ExxonMobil (XOM). CVX and XOM are components of the iShares Global Energy ETF (IXC), and they make up 22% of the ETF.

Cushing inventories

Another important figure that the EIA reports is crude oil inventories at Cushing, Oklahoma. It’s a major inland oil hub in the US. Cushing is the pricing point for the North American “benchmark”—WTI (West Texas Intermediate) crude oil.

Inventory levels at Cushing reflect the pace at which the increasing US oil supply is moving from major inland production areas—like the Bakken in North Dakota and the Permian in west Texas—to the major refining hubs situated on the Gulf Coast.

A buildup of inventories at Cushing pressures WTI crude price downwards and vice versa. We’ll cover recent activity in Cushing in a later part of this series.

In the next part of this series, we’ll discuss the latest crude inventory data in more detail.