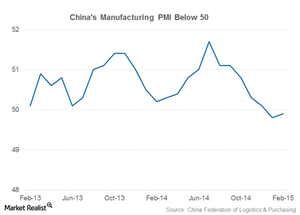

China’s manufacturing PMI below 50 for second consecutive month

China’s manufacturing PMI has been below 50 for two consecutive months. This reflects a slowdown in the Chinese economy and impacts industrial commodities.

March 17 2015, Published 11:18 a.m. ET

China’s manufacturing PMI

We’ve already seen that China is adding to its aluminum smelting capacity. Now we’ll see how aluminum demand is shaping up in China.

The manufacturing PMI (Purchasing Managers Index) is a key indicator of economic activity. Let’s take a look at China’s manufacturing PMI in this part. It’s released on a monthly basis and is based on the diffusion indices of the following five components:

- new orders – 30%

- inventory levels – 10%

- output – 25%

- supplier delivery times – 15%

- employment environment – 20%

Analysts track PMI figures closely. It can give crucial insights into future GDP (gross domestic product) levels. Readings above 50 generally indicate economic expansion. A reading below 50 indicates contraction.

In 4Q14, China’s GDP growth rate fell below 50. It was China’s lowest GDP growth rate in 24 years.

China’s PMI falls below 50

The above chart shows the trends in China’s official PMI. As you can see, China’s manufacturing PMI has been below 50 for two consecutive months. This reflects the slowdown in the Chinese economy. This slowdown impacts the demand for all industrial commodities.

Interestingly, the official Chinese PMI in February is below 50, but PMI data released by HSBC and Markit show that China’s PMI was above 50 in February.

Higher aluminum exports

The industrial sector is one of the largest consumers of aluminum in China. The demand slowdown in China is leading to higher aluminum exports. This is negative for aluminum producers such as Alcoa (AA), Vale S.A. (VALE), Rio Tinto (RIO), and Century Aluminum (CENX).

Century Aluminum (CENX) forms 3.99% of the SPDR S&P Metals and Mining ETF (XME).

Alcoa gets most of its revenues from US and European markets. In the next part, we’ll analyze the demand indicators of the US economy.