Intense competition leads to low profit margins for automakers

The auto industry has lower margins primarily because of intense competition. It makes it difficult for companies to pass on increases in raw material prices to the customer.

Nov. 19 2019, Updated 7:12 p.m. ET

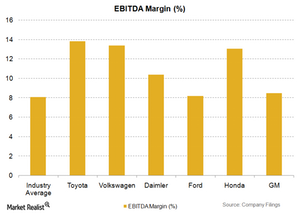

EBITDA margin

EBITDA (earnings prior to interest, tax, depreciation, and amortization) is commonly used to measure the operating margin. The EBITDA margin is the ratio of EBITDA to a company’s revenue.

Japanese automakers Toyota (TM) and Honda (HMC) have among the highest margins in the business at 13.8% and 13.1%, respectively. In contrast, General Motors (GM) has a relatively lower margin of 8.5%. Ford (F) has an EBITDA margin of 8.2%.

The First Trust NASDAQ Global Auto ETF (CARZ) has Toyota and Honda in its top three holdings. Together, they account for 17.14% of the ETF.

Japanese automakers have high profit margins

The biggest reason for the difference between Japanese and American manufacturers’ margins is the weak yen. The yen depreciated by 29.2% against the US dollar over the past two years.

Toyota exports about 56% of the vehicles it manufactures in Japan—more than both Nissan and Honda. Toyota also manufactures about 39% of its global production in Japan. This helps it achieve higher margins. A depreciating yen boosts profits on exports.

Japanese automakers are also known for using common components across different models. This results in significant savings for the manufacturer. Labor problems and significant healthcare and pension costs for US manufacturers also contribute to lower margins.

Low profit margins compared to other industries

The auto industry has lower margins primarily because of intense competition. The competition makes it difficult for companies to pass on increases in raw material prices to the customer. Due to high operating leverage, a small increase in input prices adversely affects margins by a significant percentage.

Compliance to stringent fuel emission standards and fuel efficiency requirements resulted in significant structural costs for companies as well.

Capital intensive industries typically use high amounts of debt. In the next part of this series, we’ll discuss how major automakers use leverage.