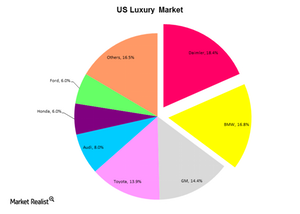

Daimler and BMW dominate the luxury car segment

German automakers lead the luxury space in the US. Daimler AG had an 18.4% share. It was followed by BMW. It had a 16.8% share.

Feb. 10 2015, Updated 1:06 p.m. ET

Luxury vehicle segment

The luxury space has an impressive 13% share of the automotive market in the US.

A luxury car belongs to one of the following segments—according to its MSRP (manufacturer’s suggested retail price):

- Entry-level

- Midrange

- Premium

Entry-level segment cars, like the Honda (HMC) Acura, start at $28,790. A Mercedes-Benz SL-Class vehicle from the Premium segment can cost as much as $121,750. Passenger cars, sports cars, and SUVs make up each segment.

US market share

As the above chart shows, German automakers lead the luxury space in the US. Daimler had an 18.4% share. It was followed by BMW. It had a 16.8% share. General Motors (GM) is third with a 14.4% share. Toyota (TM) is fourth with a 13.9% share. Toyota has the highly successful Lexus brand.

Luxury cars have higher operating margins than midsize and large cars. They have higher pricing power. Luxury brands are able to command better pricing because of the desired value of the brand.

As the largest target market, the Entry-level segment saw intense competition. The segment has a 69% share of the luxury space in terms of units. It contributes 58% to companies’ top lines.

In Entry-level luxury cars, the BMW 3 Series is the highest-selling vehicle. As of October 2014, it sold 108,066 units. The Chevrolet Camaro first went on sale in 1967. It’s still the preferred choice among Entry-level sports cars. It has a competitive MSRP of $33,300.

Daimler rules the luxury car segment

Daimler has a well-positioned cash cow in each of the three luxury car segments. It offers the Entry-level Mercedes-Benz C-Class, the Midrange E-Class, and the Premium segment S-Class. These three models contribute a healthy 52% to Daimler’s revenue. They allow the company to expand its footprint through the introduction of newer models.

The Mercedes-Benz S-Class, the GM Cadillac Escalade, and the Nissan (NSANY) Infiniti QX80 are the top three models in the Premium segment. They account for 37.5% of the segment’s market share.

The First Trust NASDAQ Global Auto ETF (CARZ) has holdings of luxury automakers—like Daimler and BMW.

Cost control is crucial for the capital-intensive auto industry. In the next few parts of this series, we’ll discuss the costs in more detail.