Valuation metrics that investors can use in the telecom industry

Investors often use different metrics to determine telecom companies’ relative valuation. Telecom is a capital-intensive industry with high fixed costs.

Nov. 20 2020, Updated 4:39 p.m. ET

Telecom companies’ valuation

Investors often use different metrics to determine telecom companies’ relative valuation. Some of these multiples are PE (price-to-earnings), price-to-free cash flow, EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization), and price-to-cash flow.

Telecom is a capital-intensive industry with high fixed costs. Telecom companies finance their capital expenditure with debt. This results in high financing costs for these companies. Also, telecom companies have a high depreciation expense, due to their networks’ large fixed asset base. The government also gives these companies special tax incentives for particular periods.

These expenses, costs, and tax breaks make earnings volatile year-over-year, or YoY. They also impact the FCF (free cash flow). It’s calculated after tax and capital expenditures. Therefore, we believe multiples like PE and price-to-free cash flow may not capture a telecom company’s fair value.

We prefer EV/EBITDA and price-to-cash flow to PE and price-to-free cash flow for the valuation of telecom companies.

EV/EBITDA multiple

EV reflects the holders’ share of a company’s sources of capital. EV is the total market value of a business’ debt, equity, preferred shares, and minority interests—net of its cash and equivalents and investment in associates. EBITDA is a fundamental measure for the company’s stakeholders. We use next year’s forecasted EBITDA to value companies.

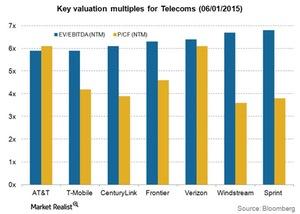

Based on this metric, AT&T (T) and T-Mobile (TMUS) each had an EV/EBITDA of 5.9x. They look underpriced compared to their peers. Sprint (S) had an EV/EBITDA of 6.8x. Windstream (WIN) had an EV/EBITDA of 6.7x. They look expensive.

Price-to-cash flow multiple

Price-to-cash flow is the other multiple we prefer to value telecom companies. As you know, major telecom companies changed their revenue recognition approach for device subsidies and mobile phones in 2014. Please read Some of the must-know trend shifts in the telecom industry to learn more.

The change in revenue recognition may impact a company’s earnings. However, it doesn’t affect the fundamental value of a business or a telecom company’s cash flow. So, investors can also use price-to-cash flow for telecom companies’ valuation. Investors can also use it if they want to compare the valuation multiples for different years.

Based on price-to-cash flow, Windstream looks attractive. It had a multiple of 3.6x. It was followed by Sprint. Sprint had a multiple of 3.8x. CenturyLink (CTL) had a multiple of 3.9x. However, AT&T and Verizon (VZ) each had a multiple of 6.1x. They appear overvalued.