Carnival stays competitive with strong financial position

Carnival has a stronger financial position than its peers. It maintained a very low debt-to-capital ratio of 28% in 2013 and just 27% in 2014.

Jan. 16 2015, Updated 12:37 p.m. ET

Cruise lines need sound liquidity and financial positions

So far, we’ve looked at Carnival Corporation’s (CCL) operational efficiency and profitability. Now we’ll have a look at its financial position.

It’s very important for a company to maintain a sound liquidity and financial position. It’s especially more important for capital-intensive companies such as those that operate in the cruise or airline industries. This is because purchase costs and operating costs of ships and aircraft are very high.

Companies with strong liquidity positions can finance their high capital requirements with internally generated cash flows. Otherwise, they have to rely on debt, which adds to the company’s already high contractual commitments.

Carnival benefits from low debt-to-capital ratio

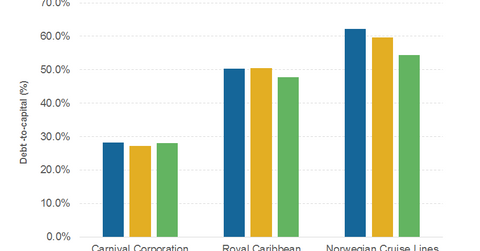

Carnival Corporation (CCL) is at an advantage since it has a stronger financial position than its peers. This is evident because it maintained a very low debt-to-capital ratio of 28% in 2013 and just 27% in 2014. Its peers, Royal Caribbean Cruises Ltd. (RCL) and Norwegian Cruise Line Holdings Ltd. (NCLH) had leverages as high as 48% and 54%, respectively, in 2013.

Investors can invest in shares of these companies through ETFs such as the PowerShares Dynamic Leisure and Entertainment Portfolio (PEJ), the PowerShares Dynamic Large Cap Growth Portfolio (PWB), and the Consumer Discretionary Select Sector SPDR Fund (XLY).

Lower leverage provides a cushion against fluctuating input costs and provides more flexibility in allocating funds.

Positive free cash flow

Although Carnival Corporation’s (CCL) cash and cash equivalents are decreasing, its cash balance as a percentage of revenue was 3% in 2013, higher than its two competitors’ at 2% to 2.6%.

Despite high capital expenditure, Carnival has been able to generate positive free cash flow consistently for five consecutive years. Free cash flow is cash available after deducting capital expenditure. It’s cash that’s available to pay debt holders and provide returns to shareholders.

Companies with higher free cash flow are in better positions to provide good returns to their shareholders. In the next article, we’ll learn more about whether Carnival Corporation (CCL) has been providing adequate returns to its shareholders.