The Must-Know Risks of Fixed Income Investing

There are no free lunches. The risks involved in fixed income investing are two-fold.

March 24 2015, Updated 7:06 p.m. ET

Of course, allocations will depend on your specific risk appetite and investment objectives, and there is no guarantee that asset allocation strategies will preserve your assets in falling markets, but combining these three strategies is just one way to customize a fixed income portfolio to better navigate today’s complex economic landscape.

Stock and bond values fluctuate in price so the value of your investment can down depending upon market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

Market Realist – The risks involved in fixed income investing are two-fold.

There are no free lunches. This statement is very true when it comes to investing. You get rewarded only by taking on risk. So, there’s always a risk-to-return trade-off.

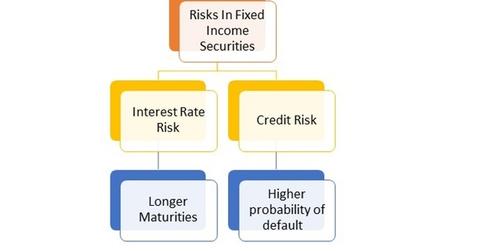

The chart above shows the two main risks involved in investing in fixed income securities: interest rate risk and credit risk.

Interest rate risk comes with investing in long-dated bonds. Credit risk, which we’ve alluded to in previous parts of this series, accompanies investing in bonds in a poor financial state, meaning a higher probability of default.

A higher interest rate, or credit risk, means issuers will have to offer a higher yield in order to attract investors.

US Treasuries (TLT)(IEF) have no credit risk. However, long-dated Treasuries do have interest rate risk. Corporate bonds (LQD) have both interest rate risk and credit risk. High yield corporate bonds (HYG)(JNK) have an even higher credit risk. Long-dated high yield bonds have the highest risk. If you invest in these kinds of bonds, you’ll be rewarded highly if interest rates fall and the credit market or the economy improves. While interest rates are likely to increase, the economy is improving, which should benefit high yield bonds.