Comparing leveraged loans and high yield bonds: Credit rating

Credit rating measures the credit-worthiness of a debtor with respect to its financial and operational stability. Rating agencies such as Moody’s and Standard & Poor’s specialize in rating credit to government agencies and corporates.

Nov. 26 2019, Updated 9:17 p.m. ET

Credit rating

Credit rating measures the credit-worthiness of a debtor with respect to its financial and operational stability. Rating agencies such as Moody’s and Standard & Poor’s specialize in rating credit to government agencies and corporates. According to Standard & Poor’s rating hierarchy, AAA, AA, and A are the highest rankings and are awarded to companies and sovereign bodies with solid proven track record, while, BB, B, CCC, and so on down the line indicate less stellar performers.

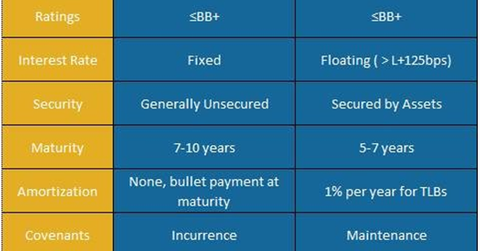

Both leverage loans and high yield bonds have non–investment-grade ratings. The definition of the “leveraged loan market” varies, but it’s generally accepted as “all corporate loans with BB+ rating or below, paying an interest rate of more than LIBOR[1. LIBOR stands for London Interbank Overnight Rate, the benchmark interest rate for many adjustable-rate mortgages, business loans, and financial instruments traded on the global financial market. Currently, the three-month LIBOR rate is 0.24%.] + 125 basis points.” On the other hand, the high yield bond market is similar in that it includes non–investment-grade bonds, which rate lower than BBB-.

Rating is a key determinant to assess the credit risk of an issuer. One of the key components of credit risk is default risk, which is the likelihood of a borrower being unable to pay interest or principal on time. Usually, the higher the rating, the lower the default rate and vice versa. Lenders and investors closely look into issuers’ credit ratings to define their investment decisions.