Why some MLPs are benefitting from increased propane exports

Significantly higher rates of propane exports have helped to boost propane prices—and the margins of some MLP names.

Dec. 4 2020, Updated 10:53 a.m. ET

Increased propane exports drive higher propane demand

U.S. propane prices are directed by supply and demand forces, and one factor in the demand equation is the amount of propane exported to international markets. More propane exported results in higher propane prices. This is a positive for certain master limited partnerships (MLPs) that process natural gas, such as DCP Midstream (DPM), Targa Resources (NGLS), Williams Partners (WPZ), and MarkWest Energy (MWE). For more on why NGL prices matter to these companies, please see Why fractionation spreads affect some MLP stocks.

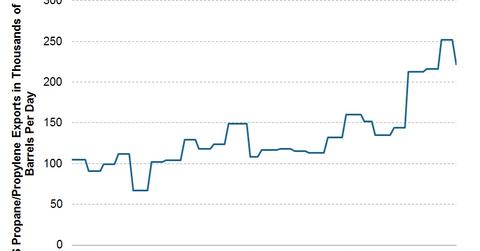

Propane exports have increased significantly through 2013

Propane exports have recently increased significantly. Through 3Q13 so far, propane exports have averaged around 240 thousand barrels per day, as compared to ~180 thousand barrels per day in 2Q13 and ~150 thousand barrels per day in 1Q13. Increased propane exports are a positive for domestic propane prices because they represent increased demand for domestic propane. U.S. propane prices have increased ~30% since mid-June—likely due in part to increased crude oil prices, as the two commodities are linked, but also likely as a result of increased propane exports.

More propane export capacity coming online further helps propane prices

Currently, domestic propane trades at a discount to international propane. This is because despite a growing amount of propane exports, export capacity has been limited by a lack of infrastructure. However, this price disparity provides an economic incentive to build the necessary infrastructure to export propane. Midstream companies have already announced projects to build or expand propane export terminal facilities, which should result in increased propane exports and support for propane prices.

For instance, Targa Resources (NGLS) has announced a project to provide additional NGL export capacity on the Gulf Coast. Targa expects to be able to load four VLGCs (very large gas carriers) per month starting in September and ramping up through October to a final rate of 3 million barrels per month. Targa also is working on increasing export loading capacity so its facilities can load 5 million total barrels per month in 3Q14.

Plus, Enterprise Products Partners (EPD) finished an expansion of an export facility earlier this year that can handle 7.5 million barrels per month of exports in total. EPD has also noted that it may pursue another project that would allow it to further increase capacity.

The takeaway is that propane exports support propane prices, and given recent trends and news of new export infrastructure, you can expect propane exports to continue to grow. Higher propane prices are a positive for natural gas processors such as such as DCP Midstream (DPM), Targa Resources (NGLS), Williams Partners (WPZ), and MarkWest Energy (MWE). They’re also a positive for the Alerian MLP ETF (AMLP), which contains many gas processing names, as a portion of revenues are tied to contracts that depend on the prices of NGLs, such as propane. For further information on why NGL prices matter, please see Why fractionation spreads affect some MLP stocks.