2 States Are Considering a Millionaire Tax, Already Have It on Upcoming Ballets

If you’re a millionaire, you could face additional taxes in certain states if they proceed with proposed millionaire tax legislation. Here’s where it’s happening and what to know.

Oct. 31 2022, Published 11:23 a.m. ET

If you’re a millionaire in the U.S., you could face additional taxes depending on where you live. In two states on either end of the country, considerations for a millionaire tax are already on upcoming ballets.

Here are the states where a millionaire tax may be put into place, plus how the potential new tax could impact your household earnings if you live in impacted places.

California’s Proposition 30 would add an additional tax on millionaires’ income.

California Governor Gavin Newsom

Californians earning more than $2 million per year may be subject to a tax on any earnings that exceed that threshold. The proposed millionaire tax, Proposition 30, would tax any income above $2 million for the year with a 1.75 percent levy. This would be in addition to the state’s highest income tax rate of 13.3 percent.

If approved, Proposition 30 would become effective in California as early as Jan. 1, 2023. As proposed, it expires in January 2043 (but could end earlier if the state lowers its greenhouse gas emissions enough ahead of time).

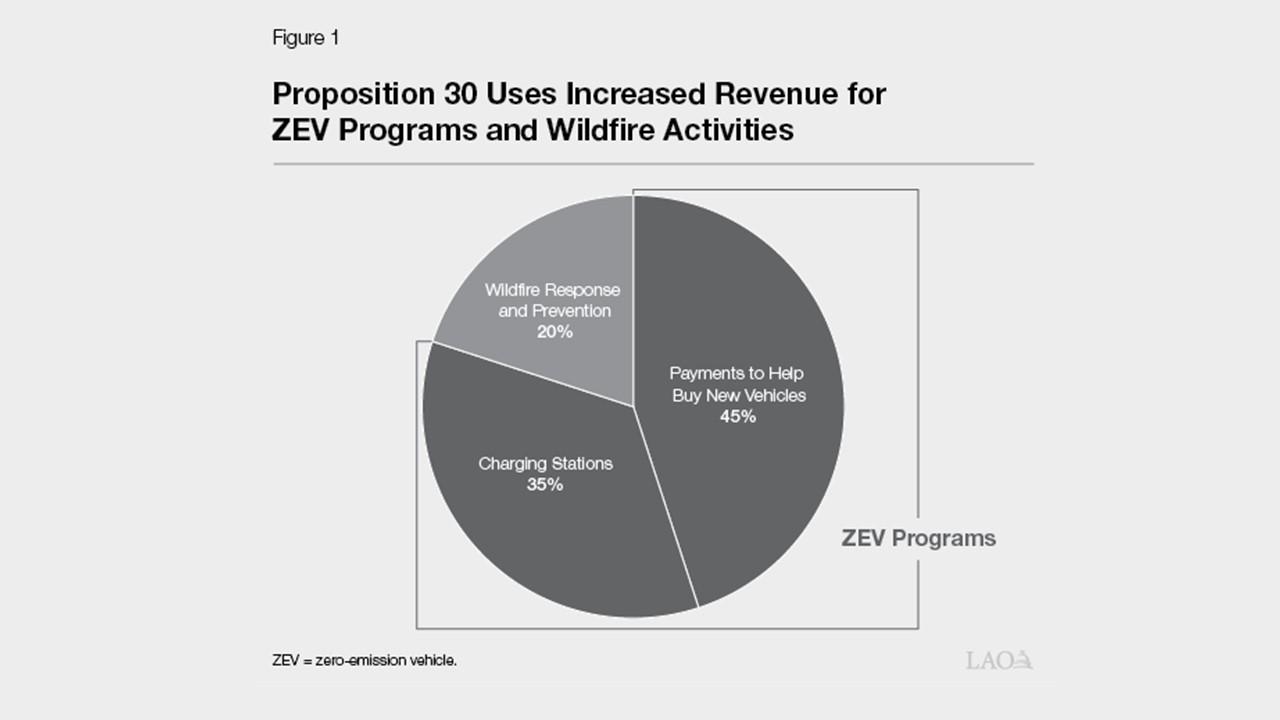

The money would provide funding for the state to increase its share of zero-emission electric vehicles and push its wildfire response and prevention programs.

Will it really happen? Statewide ballot measures like this one must have the support of a majority of people, which could be hard to come by from California’s millionaires (and billionaires) club. If enough earners raking in less than $2 million per year vote yes, it has potential.

In Massachusetts, the Fair Share Amendment seeks to tax 10-figure earners.

On the other side of the country in Massachusetts, another potential millionaire tax is hitting ballots. The Fair Share Amendment would instate a 4 percent levy on any earnings over the $1 million mark. This would be in addition to the state’s existing 5 percent tax, which is a flat rate for all income classes. Given this fact, the term “fair share” makes sense, because millionaires are paying the same proportion of earnings as those hovering over the poverty line.

Even with this tax, the total income tax rate for people earning more than $1 million per year would still be lower than the standard income tax rate for the wealthiest Californians.

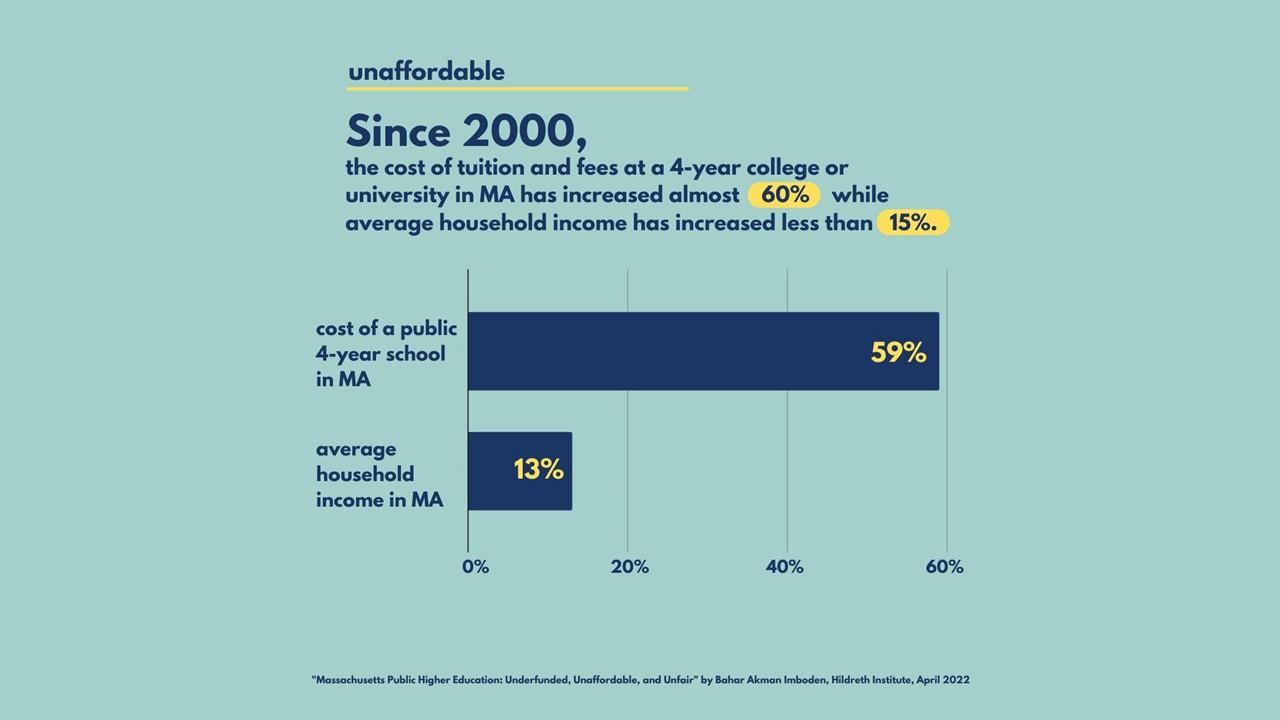

Unlike California, the proposed millionaire tax in Massachusetts would fund things like public education, roads, bridges, and public transportation.

For Massachusetts, this would be a progressive tax code change that has been a long time coming. Overall, the state’s tax burden impacts low-income taxpayers more heavily than it does high-income earners.

As for whether we’ll see the changes come to fruition, The Tax Foundation’s Jared Walczak told reporters, “We’ve seen voters reject income tax increases on high earners, even when it applies to relatively few people.” This, he says, means the ballot measures aren't a sure thing. Plus, if implemented, wealthy taxpayers could potentially find loopholes in the system to maintain an income that’s below the threshold for these additional levies.