Lost Your Tax Docs? You Can File Back Taxes Without Records

Taxes can feel intimidating, and might be even scarier if you're trying to file taxes without records. Here's how to file back taxes without records.

April 21 2023, Updated 5:48 p.m. ET

Taxes can be a confusing yearly feat to tackle, especially if you're looking at back taxes. The IRS requires a great amount of detail from you regarding your financial records, and it's easy to get overwhelmed. Taxes require documentation, records, forms, and other official statements that validate your yearly monetary history.

Some documents could get overlooked, or your records might go missing throughout the year. However, it's possible to file back taxes without records. Not every single taxpayer can always present the exact documentation the IRS needs. Here's how to file back taxes without records and what to do if you are missing tax records.

1. If you're missing records and need to file back taxes, you can send prior-year tax records to the IRS

If you are scrambling to find the documents needed to support your tax claims, no worries. There are a few ways to file back taxes without records. The IRS keeps your personal information from previously filed taxes. So, you can request tax return transcripts from up to six years ago. Return transcripts can sometimes provide information for other forms that you need to fill out.

To retrieve tax return transcripts, call the IRS or use their official "Order a Transcript" feature. If neither of these options applies to you, you can contact the IRS through mail or fax. There is no fee for copies of transcripts that are at most three years old. If you're requesting a physical copy, you'll have to pay a $57 fee for every copy of a tax return previously processed.

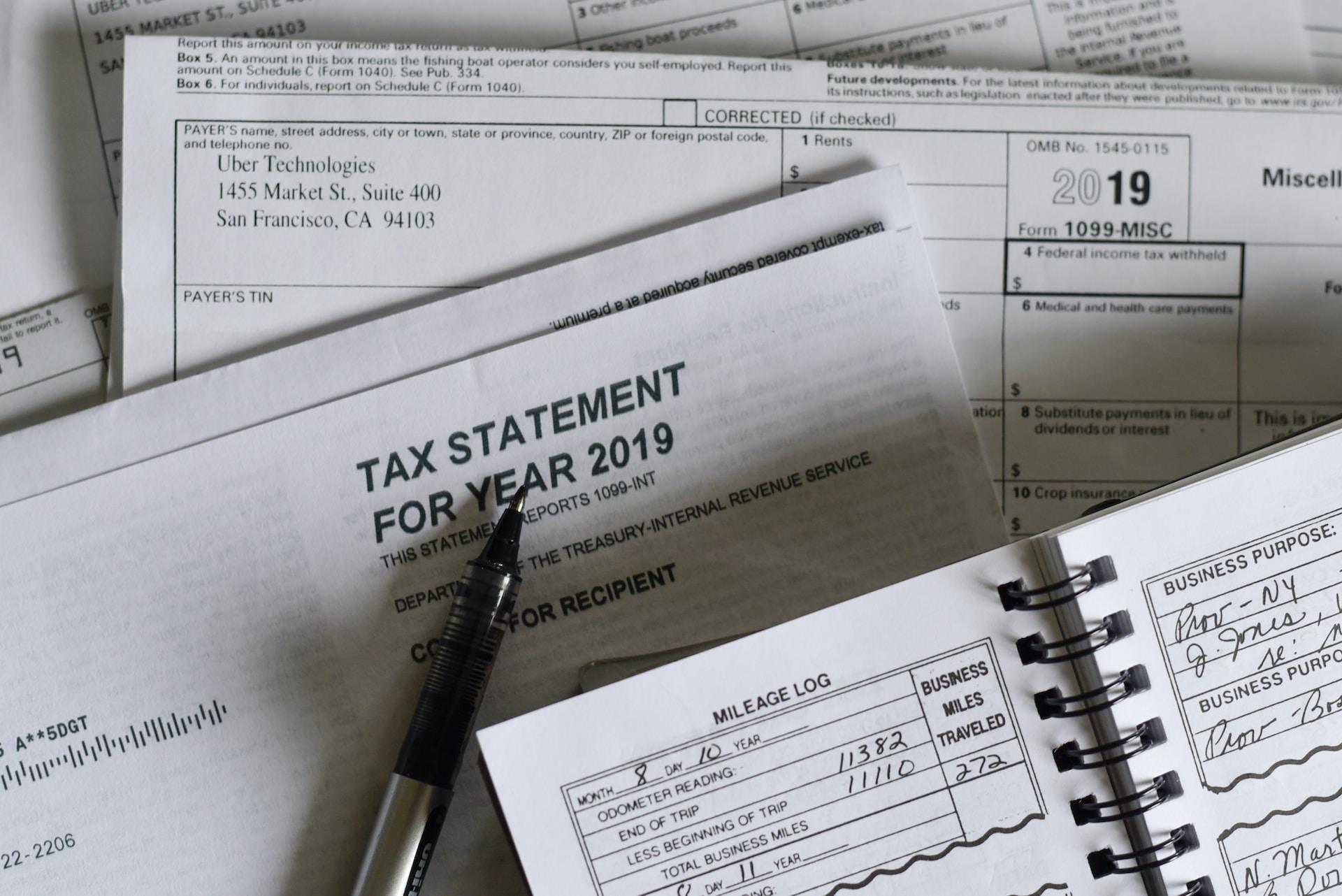

2. You should file a request for 1099 forms

You can also file back taxes without records by retrieving any missing 1099 forms from whoever issued them to you. The deadline for any 1099 forms is Jan. 31, so if you still haven't received a copy from their distributor and you're near that date, stay patient for a bit longer. If they haven't hit that deadline or your 1099 forms are still missing when tax season rolls around, consider reaching out to your bank or financial institution.

Some banks, financial institutions, and credit unions may offer you a summary or key points of your 1099 form. If you can pull together the information requested on tax forms, you won't need to provide all the documentation. If you don't have Form I099-MISC with you at the time of tax collection, you can add up your pay stubs and then request a form to record them on. This only counts toward any earning of $600 or more.

3. Take the time to look through past bank statements

Looking through your old bank or credit card statements can provide the information needed on your tax forms without hunting for official records. Credit card statements or bank records keep track of deposits, business expenses, withdrawals, and any other financial activity the IRS needs.

Online banking has made it incredibly easy to go back and pull information when filing taxes without records. You can download these files online or contact a financial institution for assistance. Social security forms or online tax software can also help you find the necessary information. You could also scan over other tax forms to find missing information.

4. Use your past W-2 forms for help

Much like asking the IRS to dig up old tax records, you can make a similar request from the IRS regarding your old W-2 form. You can ask the IRS for copies of your past W-2s from up to six years ago. The IRS will provide you with a step-by-step guide, and it may take the IRS up to 10 days to fully process the request. If you're asking for priorly-filed W-2 forms through the mail or fax, be prepared to wait up to 30 days for your documents to get into your hands.

Some taxpayers only need their W-2 to completely fill out the 1040-EZ Return Form. If you're pressed for time, you can reach out to your employer's HR department to request a replacement form if theirs goes missing. In some cases, this method is quicker than waiting for the IRS to issue a copy of the taxpayer's previous W-2 when filing back taxes without records.