Xcerra Corp

Latest Xcerra Corp News and Updates

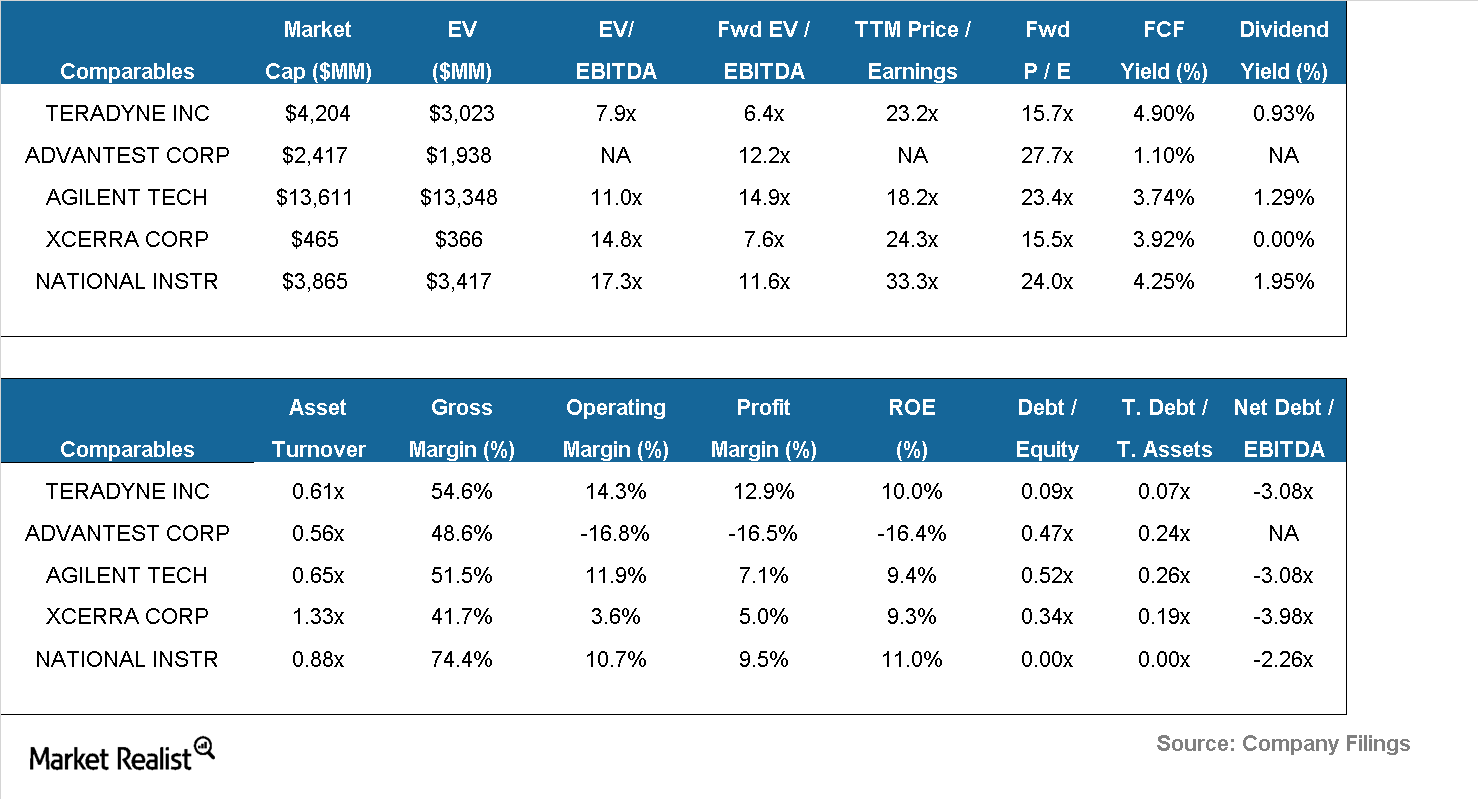

Is Teradyne fairly valued relative to its peers?

Presently, ten analysts have given Teradyne a buy rating, and four have issued a neutral rating, for a consensus target price of $22.17.

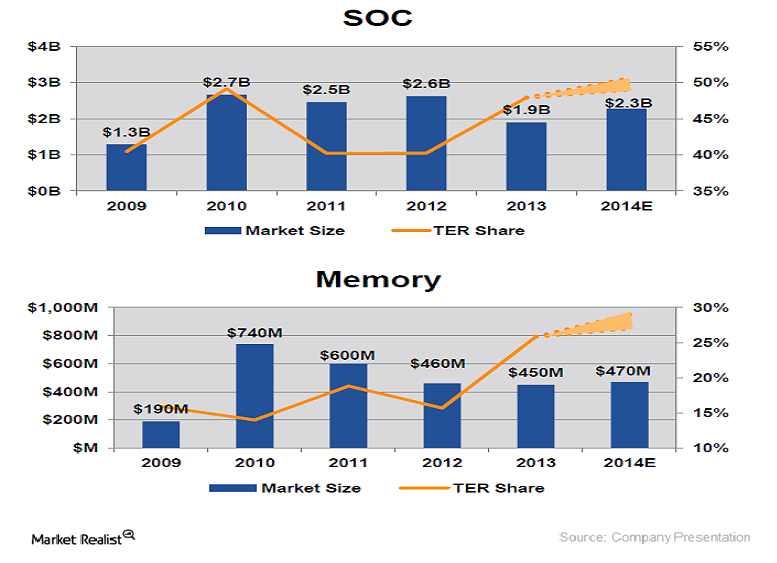

Teradyne boasts encouraging market share gains

Teradyne has about 26% share of the $470-million memory testing market. The company expects to gain 3 to 5 points of share this year.