Vulcan Materials Co

Latest Vulcan Materials Co News and Updates

Infrastructure Stocks Set To Benefit From Biden’s $1 Trillion Infrastructure Plan

With Biden’s new infrastructure plan, many stocks are set to benefit from the influx of funding. Here are some of them.

Buy U.S. Concrete Stock Before It Merges With Vulcan Materials

Now is the time to buy stock in U.S. Concrete Inc. after the company announced that it's being purchased by competitor Vulcan Materials Company.

The Outlook for the Vulcan Materials Company

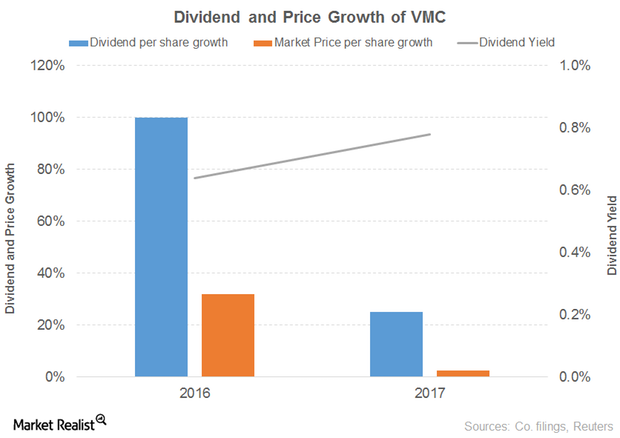

The Vulcan Materials Company’s (VMC) revenue grew 5% and 7% in 2016 and 9M17, respectively. Aggregates, concrete, and calcium drove the growth in 2016, offset by asphalt mix.