United Natural Foods Inc

Latest United Natural Foods Inc News and Updates

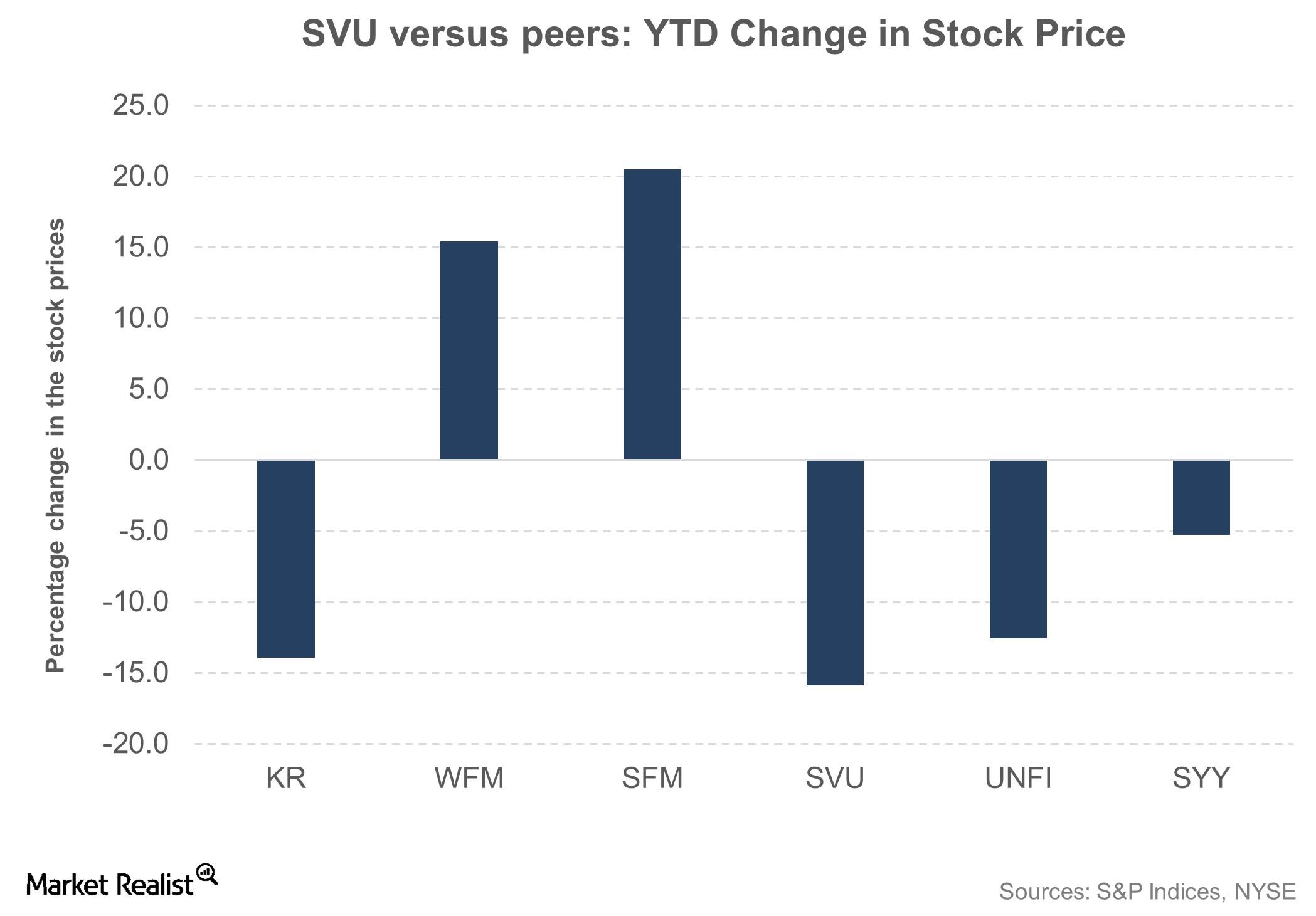

How Has Supervalu’s Stock Performed?

After falling around 30% in 2016, Supervalu’s (SVU) stock continues to be in the red in 2017.

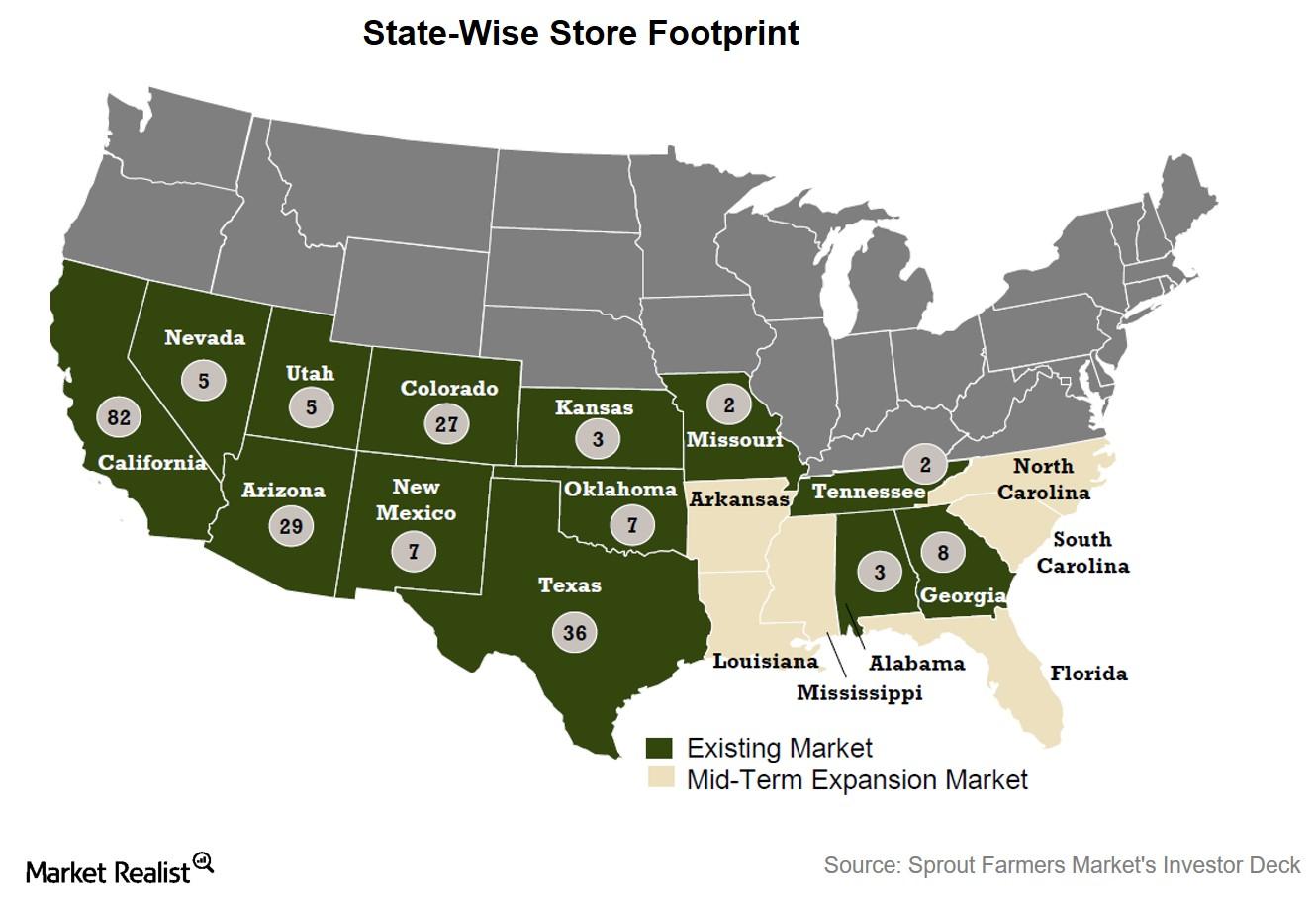

A Key Business Overview of Sprouts Farmers Market

Sprouts is a value player in the organic grocery sector, selling groceries at competitive prices from small-box stores averaging 28,000–30,000 square feet.