Domtar Corp

Latest Domtar Corp News and Updates

Bank of America/Merrill Lynch Upgrades Greif to a ‘Buy’

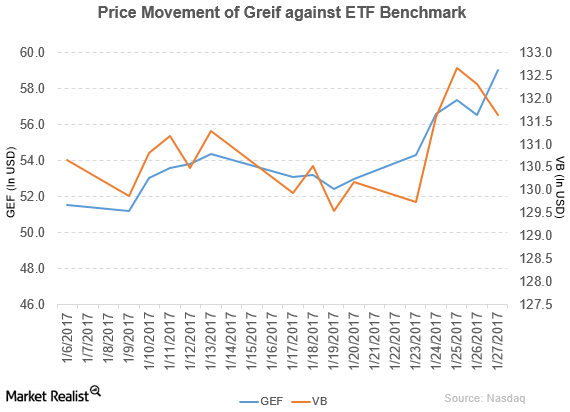

In fiscal 2016, Greif (GEF) reported net sales of $3.3 billion, a fall of 8.1% year-over-year.

Snyder’s-Lance Appoints Pease as Executive Vice President

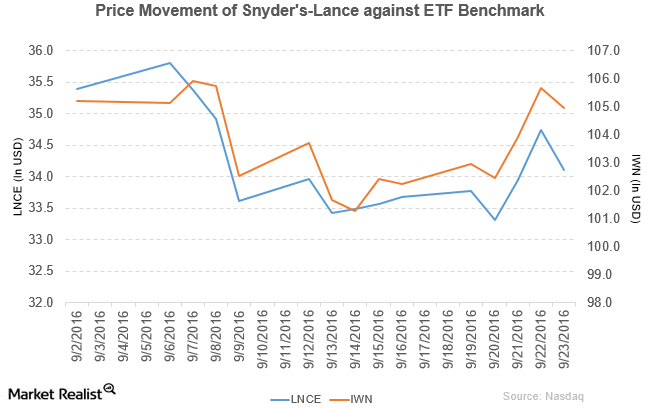

Price movement Snyder’s-Lance (LNCE) has a market cap of $3.3 billion. It fell 1.8% to close at $34.10 per share on September 23, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.3%, -3.3%, and 0.92%, respectively, on the same day. LNCE is trading 1.5% below its 20-day moving average, 1.8% below […]

Goldman Sachs Rated WestRock Company as ‘Neutral’

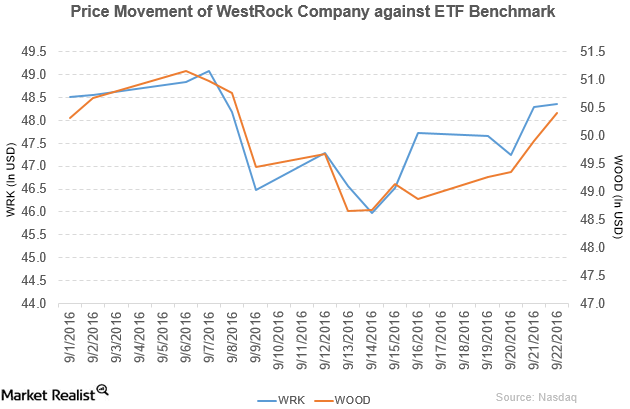

WestRock (WRK) reported fiscal 3Q16 net sales of $3.6 billion, a rise of 44.0% compared to net sales of $2.5 billion in fiscal 3Q15.

How Did Domtar Perform in 2Q16?

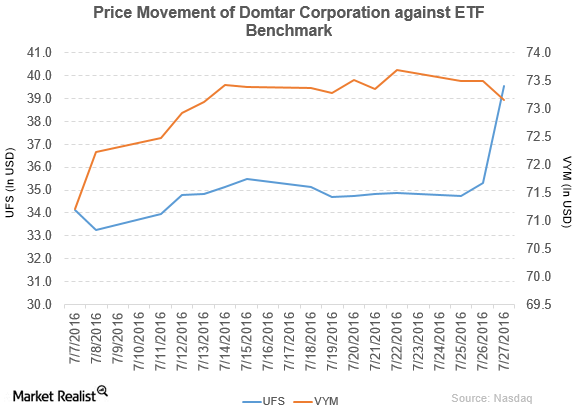

Domtar (UFS) has a market cap of $2.5 billion. It rose by 11.9% to close at $39.53 per share on July 27, 2016.

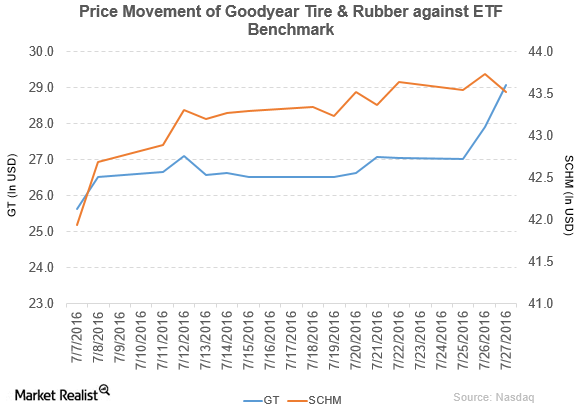

How Did Goodyear Tire & Rubber Perform in 2Q16?

Goodyear Tire & Rubber Company (GT) has a market cap of $7.8 billion. It rose by 4.2% to close at $29.09 per share on July 27, 2016.

Deutsche Bank Downgrades Packaging Corporation of America

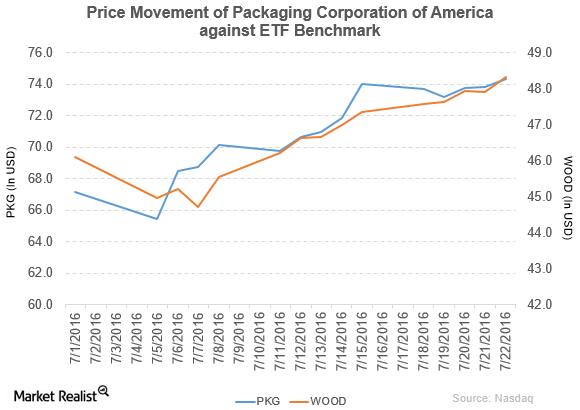

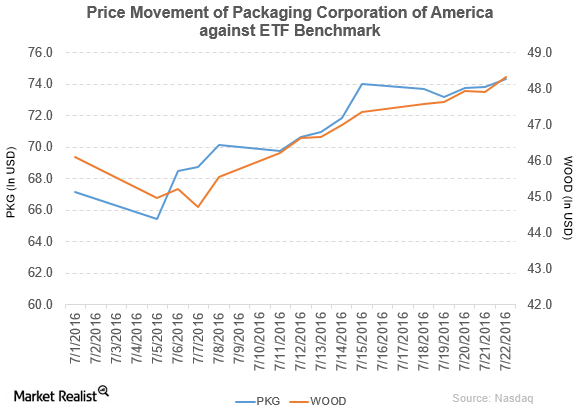

Packaging Corporation of America (PKG) has a market cap of $7.0 billion. It rose by 0.72% to close at $74.34 per share on July 22, 2016.

How Packaging Corporation of America Performed in 2Q16

Packaging Corporation of America rose by 0.42% in the third week of July. Its weekly, monthly, and YTD price movements were 0.42%, 9.0%, and 20.1%.

Buckingham Research Downgrades Packaging Corporation of America to ‘Neutral’

Its net income and EPS (earnings per share) rose to $102.6 million and $1.09, respectively, in 1Q16, as compared to $89.6 million and $0.92, respectively, in 1Q15.

Moody’s Says PKG’s TimBar Acquisition Is Credit Positive

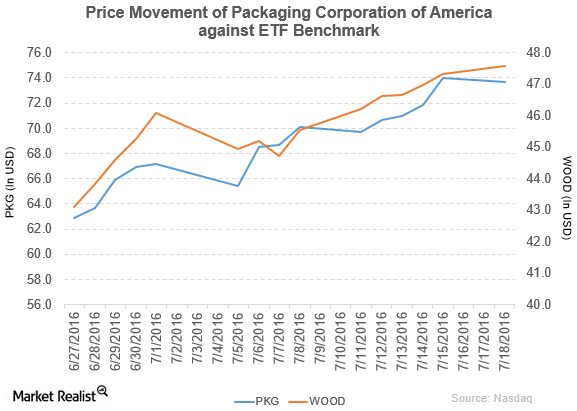

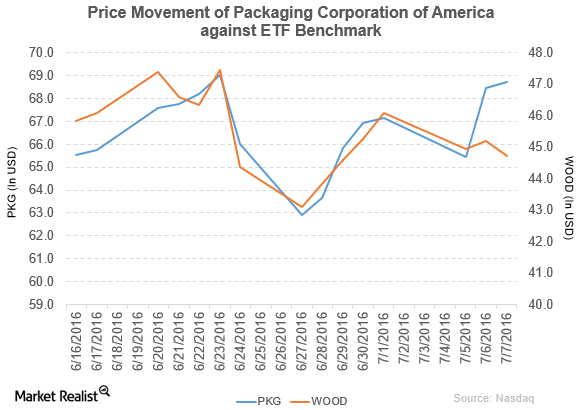

Packaging Corporation of America rose by 0.34% to close at $68.71 per share on July 7. Its weekly, monthly, and YTD movements were 4.3%, -2.6%, and 11.0%.