Tandem Diabetes Care, Inc.

Latest Tandem Diabetes Care, Inc. News and Updates

Tandem Diabetes Care’s International Expansion Strategy

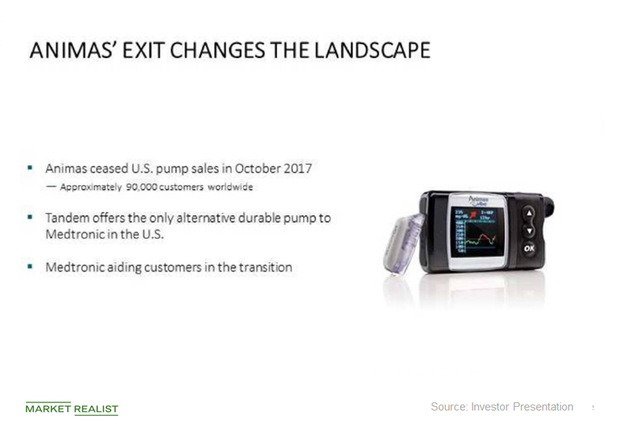

Tandem Diabetes Care (TNDM) is slated to begin its international expansion later this year to capture opportunities arising after Johnson & Johnson’s (JNJ) exit from the insulin pump market, which was announced in October 2017.

How Tandem Diabetes Care Is Advancing Its Product Pipeline

Tandem Diabetes Care (TNDM) plans to file an application seeking FDA approval for use of its Control-IQ technology in t: slim X2 insulin pumps for patients aged 14 and above.

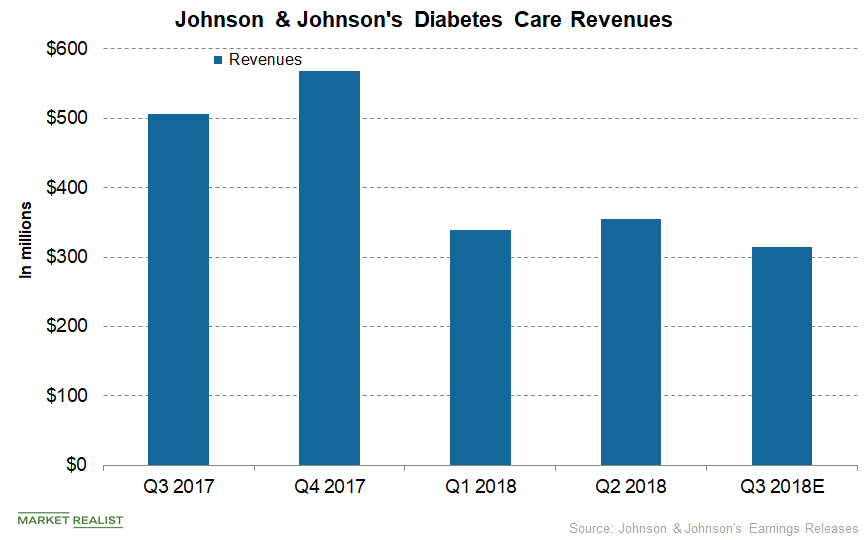

A Look into Johnson & Johnson’s Diabetes Care Business

In the US and international markets, Johnson & Johnson’s Diabetes Care segment generated third-quarter net revenues of $125.0 million and $190.0 million, respectively.

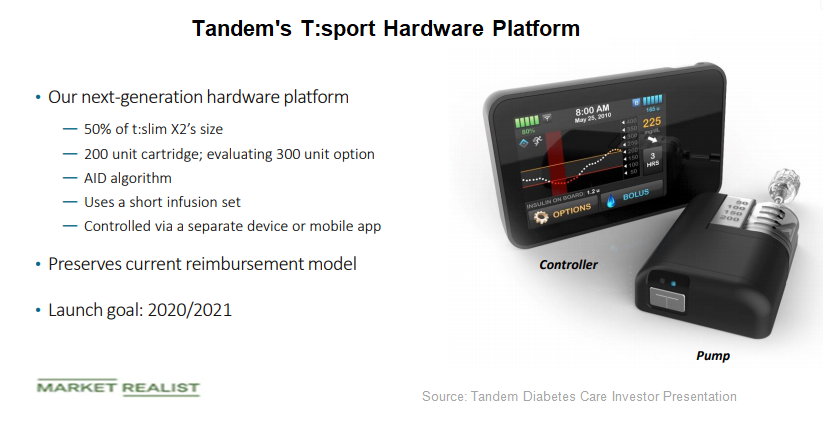

What to Expect from Tandem’s Product Pipeline

T:sport is Tandem’s next-generation hardware platform, which is expected to reduce the size of the t:slim pump by 50%.