Seattle Genetics Inc

Latest Seattle Genetics Inc News and Updates

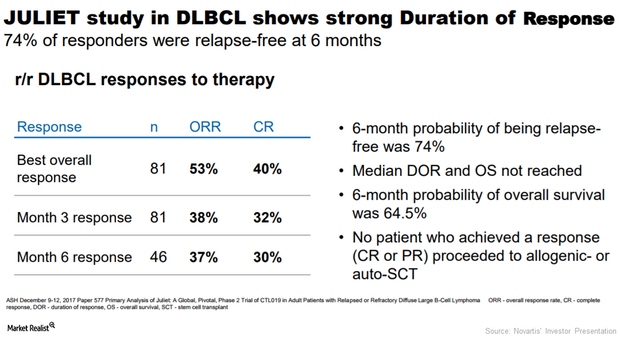

Key Updates on Novartis’s Kymriah

In December 2017, Novartis (NVS) presented updated results from the Juliet clinical trial, which demonstrated sustained responses of Kymriah (tisagenlecleucel) for the treatment of adults with relapsed or refractory diffuse large B-cell lymphoma (or DLBCL).

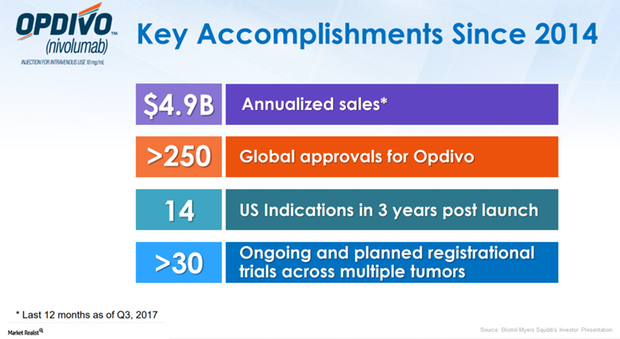

Opdivo Could Be Long-Term Growth Driver for Bristol-Myers Squibb

In 1Q17, 2Q17, and 3Q17, Opdivo reported revenues of $1.1 billion, $1.2 billion, and $1.3 billion, respectively.

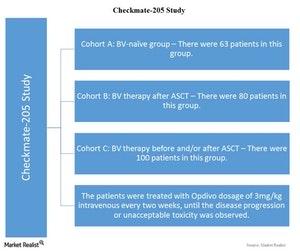

Data from the Checkmate-205 Study Evaluating Opdivo

Follow-up data were released from the Checkmate-205 study. It evaluated long-term effects of PD-1 inhibitors in patients with classical Hodgkin Lymphoma.