Guggenheim Raymond James SB-1 Equity ETF

Latest Guggenheim Raymond James SB-1 Equity ETF News and Updates

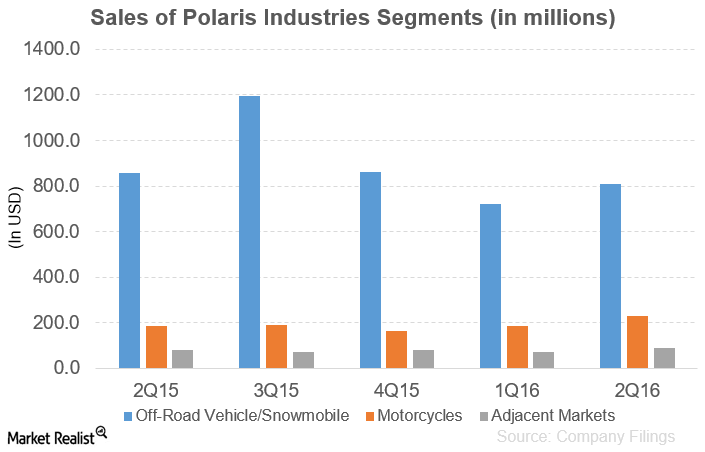

How Did Polaris Industries’ Segments Fare in 2Q16?

In 2Q16, Polaris Industries (PII) reported sales of $1,130.8 million, a fall of 0.58% compared to the corresponding period last year.

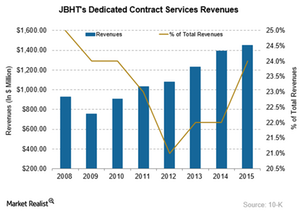

J.B. Hunt Transport’s Dedicated Contract Services Division

J.B. Hunt Transport (JBHT) has a network of roughly 89 cross-dock locations throughout the US to support the company’s final-mile, or last-mile, delivery services.