PowerShares DWA Industrials Momentum ETF

Latest PowerShares DWA Industrials Momentum ETF News and Updates

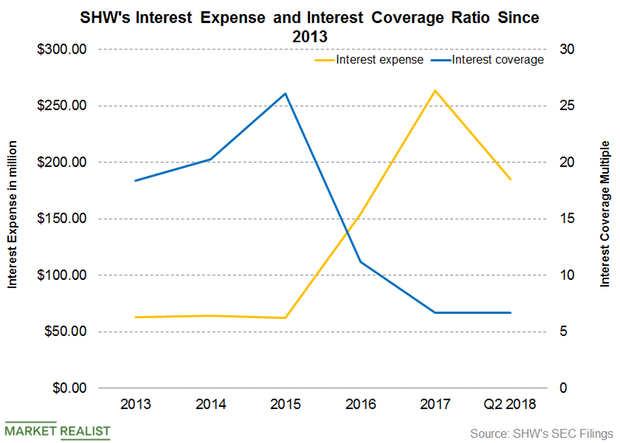

Analyzing Sherwin-Williams’s Ability to Service Its Debt

Sherwin-Williams’s (SHW) interest expense has increased significantly due to borrowings for the Valspar acquisition.

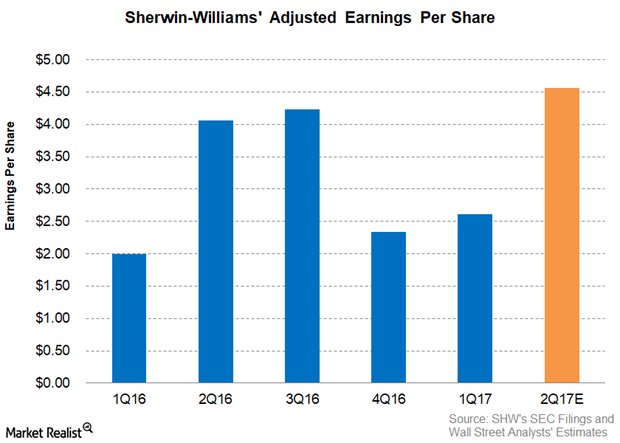

Analysts Expect Sherwin-Williams’ 2Q17 Adjusted EPS to Rise

Analysts expect Sherwin-Williams (SHW) to post adjusted EPS (earnings per share) of $4.56 in 2Q17—an increase of 12.2% on a year-over-year basis.

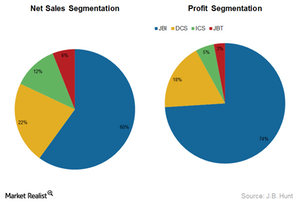

Analyzing how J.B. Hunt makes money

In this part of the series, we’ll discuss how JBHT makes money. In 2013, JBHT’s revenues increased by 500 million. Its total revenue was $5.6 billion.