Omnicom Group Inc

Latest Omnicom Group Inc News and Updates

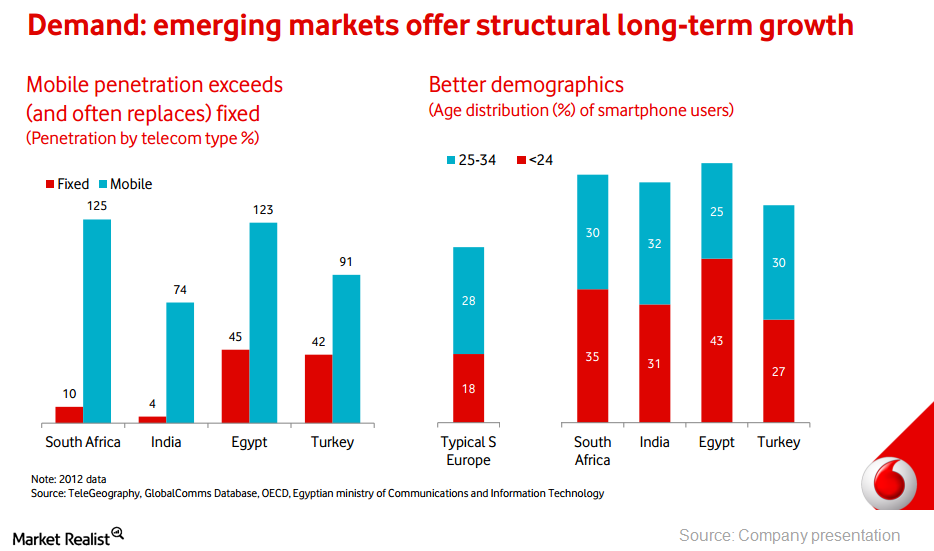

Why AQR Capital Management chose to open a position in Vodafone

AQR Capital started a new position in Vodafone Group plc that accounts for 0.44% of the fund’s 4Q portfolio.

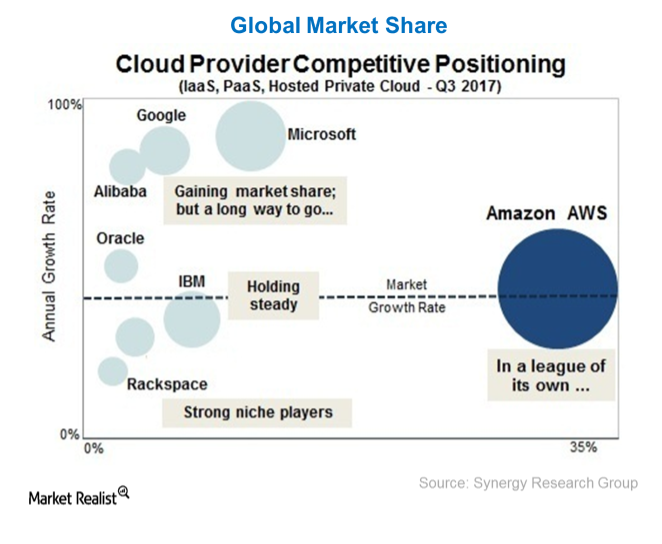

Why Google Is Not in Favor of Ad Agency Disintermediation

In the cloud computing industry, Google is behind market leaders Amazon (AMZN) and Microsoft (MSFT) and it is trying many strategies to bolster its position.

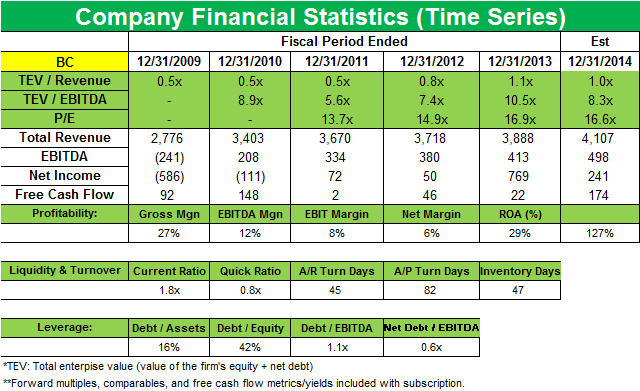

Why Davidson Kempner initiates new position in Brunswick Corp.

Brunswick is a leading global designer, manufacturer, and marketer of recreation products including marine engines, boats, fitness equipment, and bowling and billiards equipment.