Olin Corp

Latest Olin Corp News and Updates

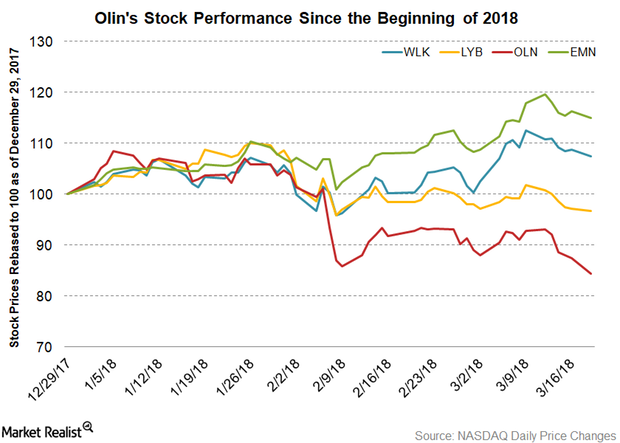

How Olin Stock Has Fared in 2018 Year-to-Date

On a year-to-date basis, until March 19, 2018, OLN stock has fallen 15.5%.

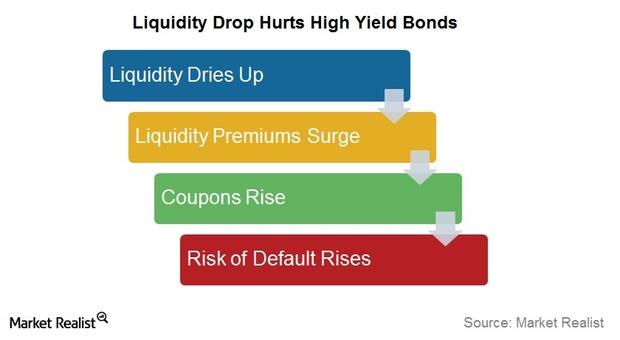

Investors in Junk Bond Mutual Funds Should Worry about Liquidity

If liquidity declines for junk bonds, the liquidity risk premium would rise. This would increase the coupon set on the bond. It will raise the borrowing cost for a company.