VanEck Vectors 12-17 Year Muni ETF

Latest VanEck Vectors 12-17 Year Muni ETF News and Updates

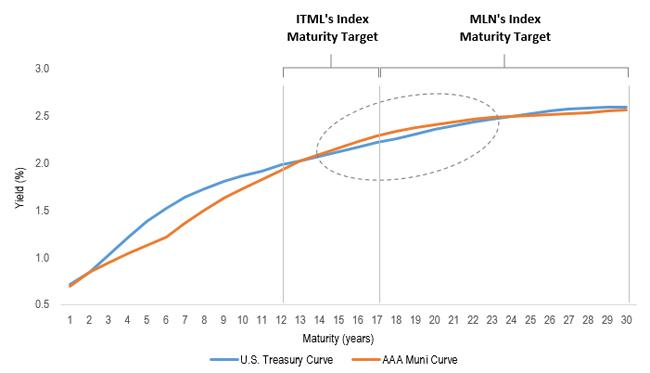

Attractive Relative Yields from Muni Bonds

We believe recent municipal bond weakness is an opportunity to put money to work at lower prices than what we have seen for some time. High quality, triple-A rated municipal bonds with maturities between 13 to 23 years currently offer higher nominal yields than 10-year U.S. Treasuries, making them particularly attractive, as shown in the […]

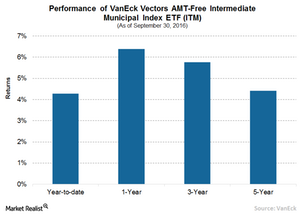

VanEck Launches Two New Intermediate-Term Municipal Bond Funds

In September 2016, VanEck introduced two new ETFs that provide exposure to intermediate-term municipal bonds.

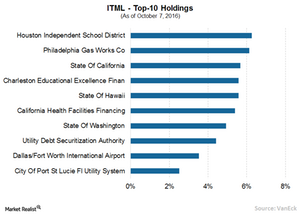

ITML: Taking a Less Conservative View of the Marketplace

With a longer duration of the intermediate bonds rate curve, ITML is best suited for investors who are uncertain about the movement of interest rates in the near future.

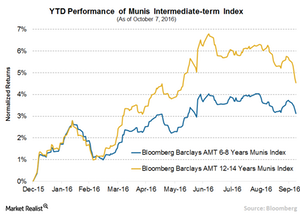

Intermediate-Term Municipal Bonds Are in a Sweet Spot

Immediate-term bonds (ITM) are better placed since investors take less of an interest rate risk.

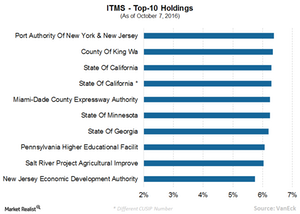

ITMS: Taking a Very Narrow View of the Municipal Yield Curve

As of September 30, 2016, ITMS has all of its investments in US dollar-denominated bonds with a credit rating of “A” or higher, thus ensuring lower risks.