iShares S&P Small-Cap 600 Value

Latest iShares S&P Small-Cap 600 Value News and Updates

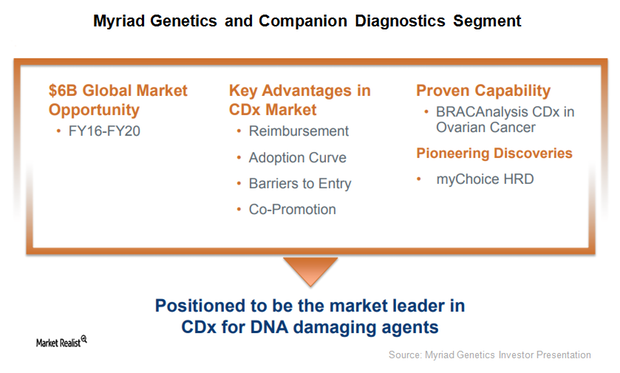

This Could Be a Solid Growth Driver for Myriad Genetics in 2018

Myriad Genetics (MYGN) announced the U.S. Food and Drug Administration’s (or FDA) acceptance of its supplementary premarket approval application for BRACAnalysis CDx, a DNA sequencing companion diagnostic test.

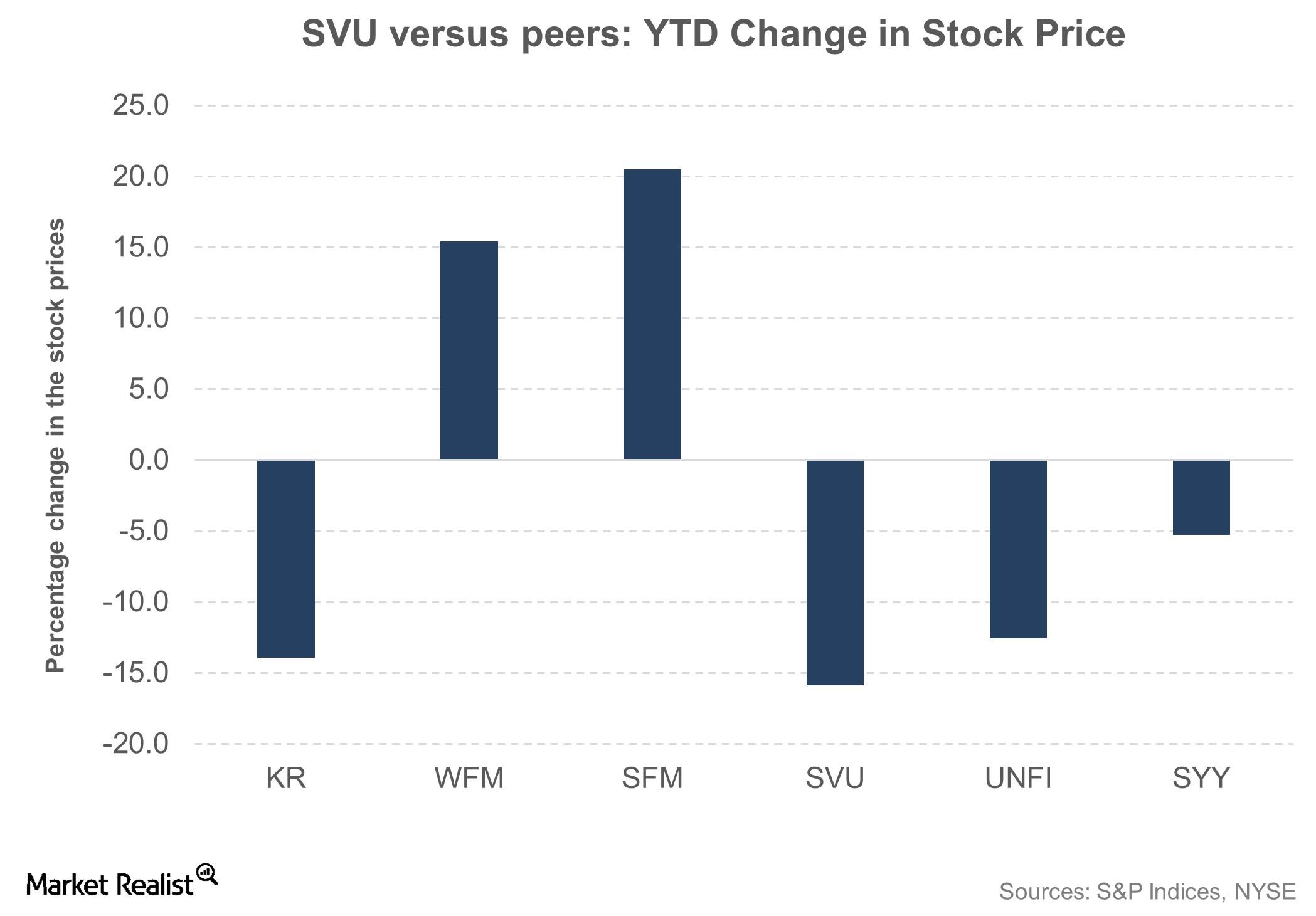

How Has Supervalu’s Stock Performed?

After falling around 30% in 2016, Supervalu’s (SVU) stock continues to be in the red in 2017.