iShares North American Tech-Multimd Ntwk

Latest iShares North American Tech-Multimd Ntwk News and Updates

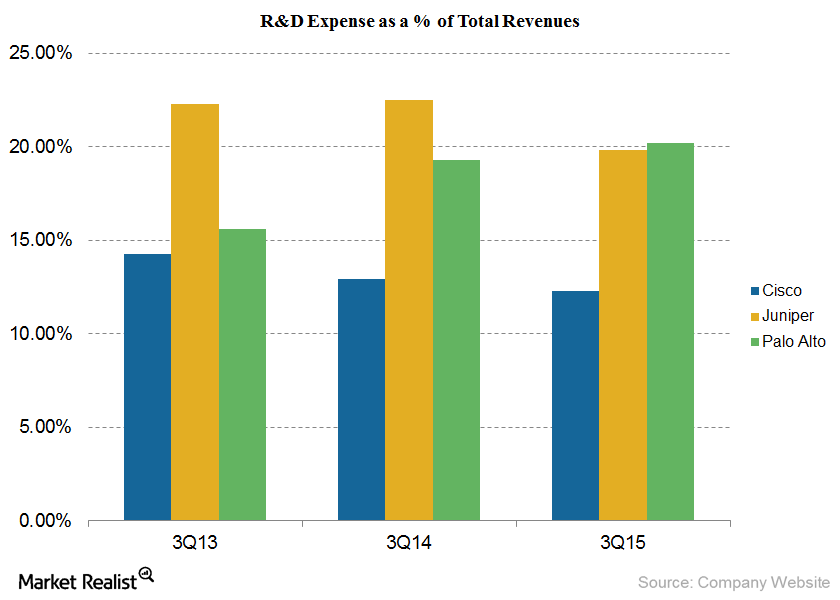

How Do R&D Expenses Compare for Cisco, Juniper, and Palo Alto?

In 3Q15, Palo Alto’s (PANW) research and development (or R&D) expenses increased to $60 million from $37 million in 3Q14 and $20 million in 3Q13.

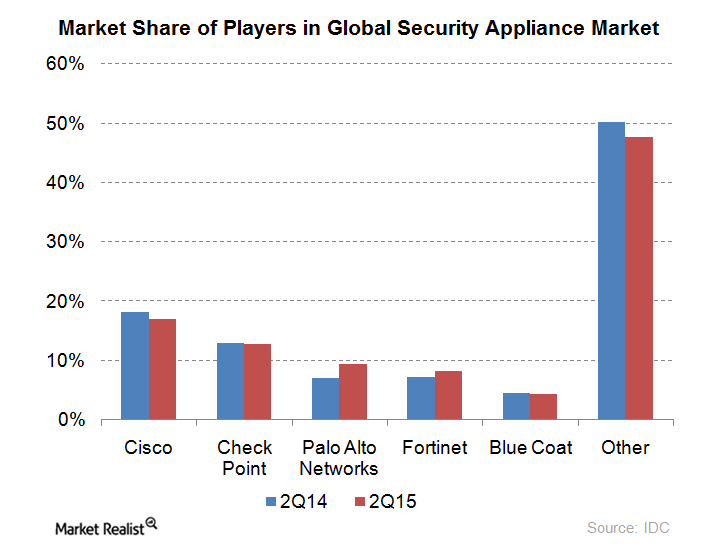

Why Palo Alto Networks’ Security Appliance Market Share Could Rise

Palo Alto Networks, which operates in the cyber security space, is growing fast. The industry is expected to grow from $77 billion in 2015 to $170 billion in 2020.