AGL Resources Inc

Latest AGL Resources Inc News and Updates

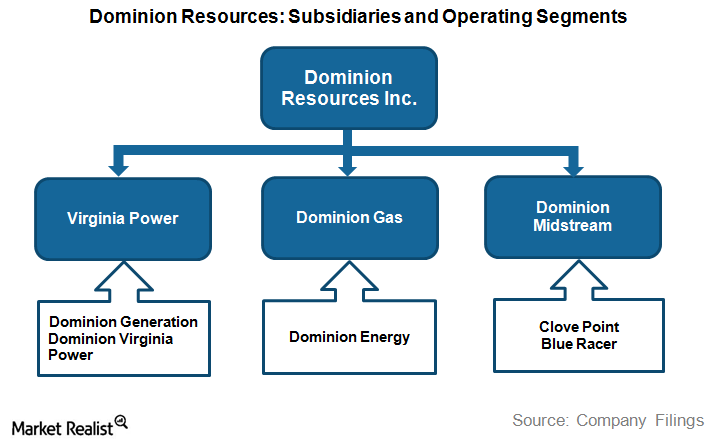

Understanding Dominion Resources’ Corporate Structure

Dominion Resources engages in all stages of the energy value chain, including power generation, transmission, and distribution.Energy & Utilities Overview: Clean Energy Fuels Corp’s operations and financials

As of December 31, 2013, CLNE served ~779 fleet customers operating ~35,240 natural gas vehicles—it also owns and operates 471 natural gas fueling stations.