First Trust Large Capital Value AlphaDEX Fund

Latest First Trust Large Capital Value AlphaDEX Fund News and Updates

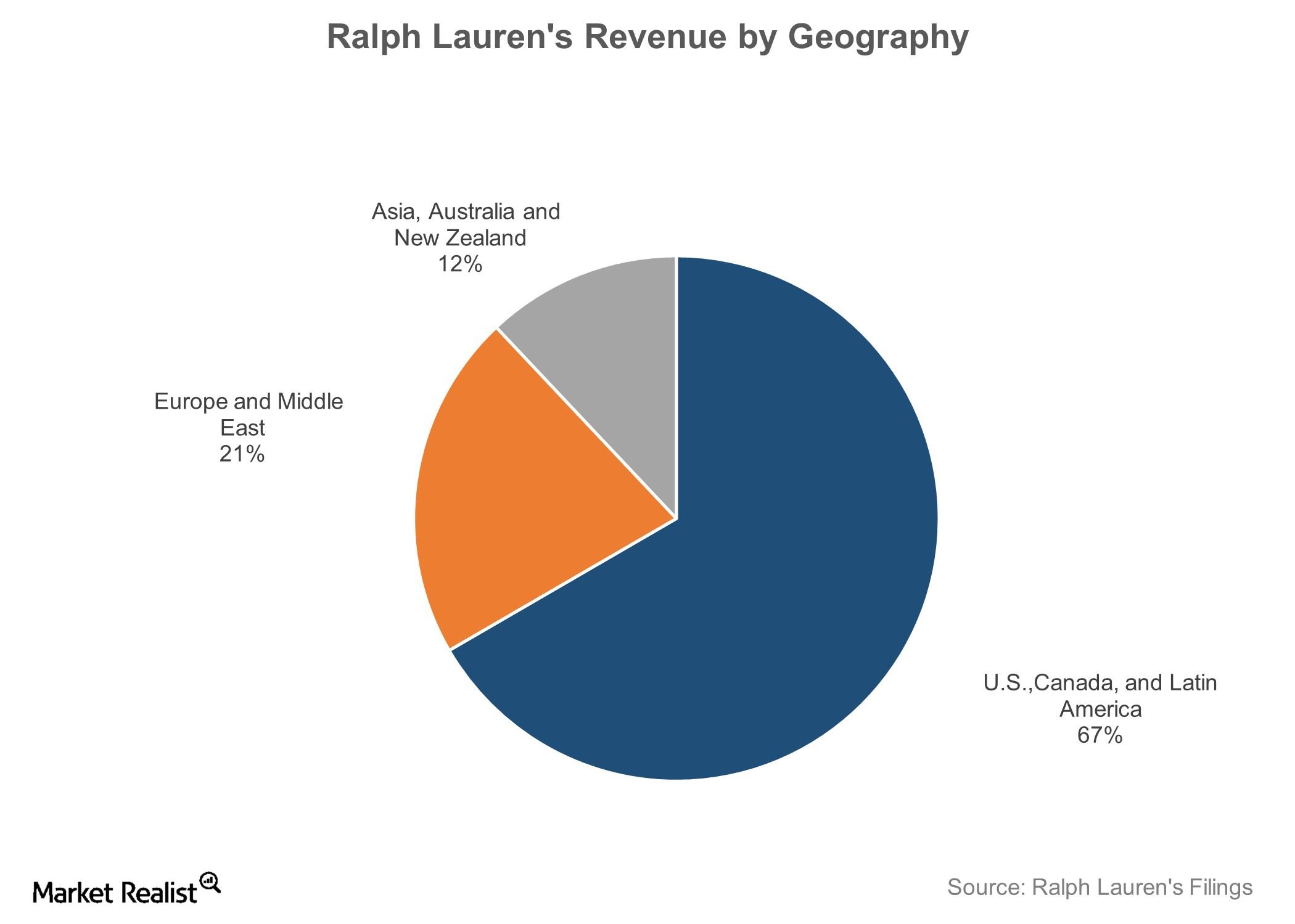

Inside Ralph Lauren’s Key Strengths, Potential Upsides, and Key Risks

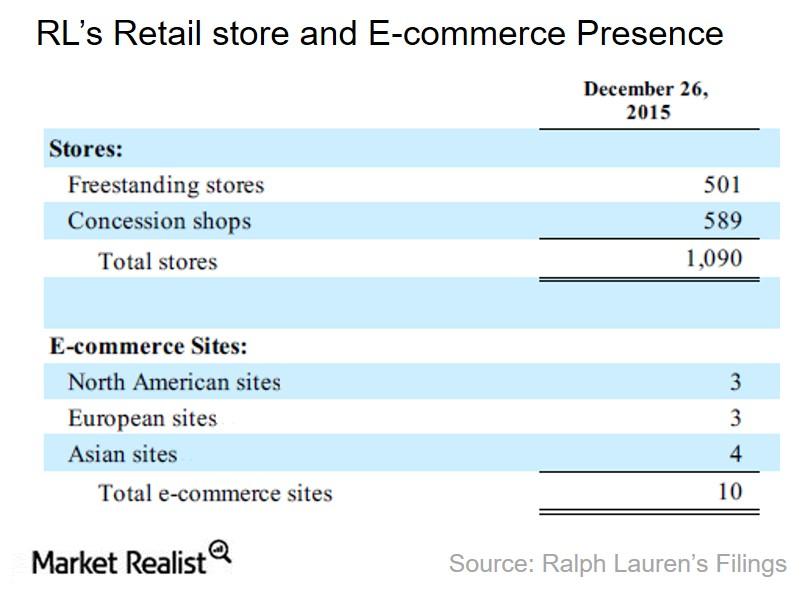

Ralph Lauren’s merchandise is available through ~13,000 wholesale distribution channels, 501 retail stores, 589 shops-within-shops, and ten websites.

How Did Ford Motor Perform in August 2016?

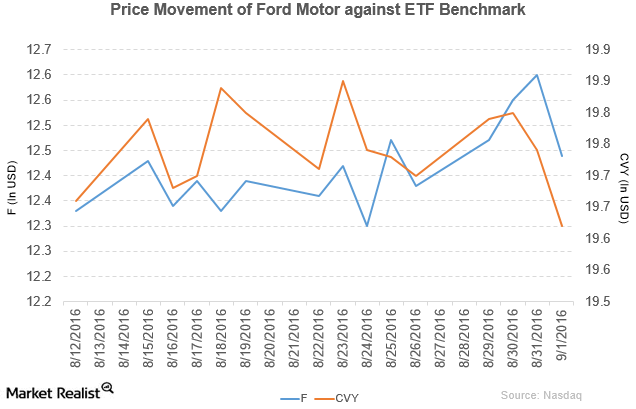

Ford Motor fell by 1.3% to close at $12.44 per share on September 1, 2016. Its weekly, monthly, and YTD price movements were -0.24%, 2.6%, and -6.7%.

Ralph Lauren: Where It Began, What It Offers, and Who It’s up Against

Ralph Lauren was founded by Ralph Lauren in 1967 and offers apparel, accessories, home products, and fragrances under several well-known brand names.