Fidelity Select Automotive Port

Latest Fidelity Select Automotive Port News and Updates

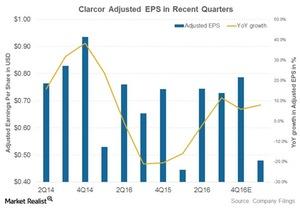

Higher Productivity and Lower Sales Highlight Clarcor’s 3Q Results

Clarcor beat Wall Street estimates by four cents with 3Q16 adjusted earnings per share (or EPS) of $0.73.

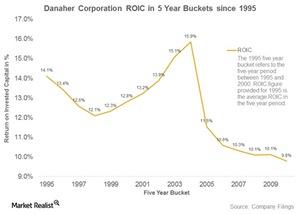

Is Danaher Losing Its Competitive Advantage?

We analyzed Danaher’s (DHR) ROIC in the 20-year period between 1995 and 2015 and classified the period of study into 16 buckets of five years each.

How Stanley Black & Decker Came to Be

Stanley Black & Decker (SWK), a Fortune 500 company, is the world’s leading tool company. It provides a wide array of products to the construction (XHB) and automobile (FSAVX) end markets.

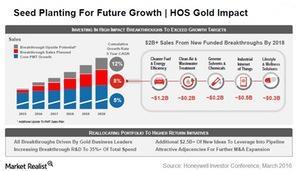

Honeywell Operating System: From ‘Honey Hell’ to Honeywell

David Cote, who took over as chairman and CEO of Honeywell, helped shape the Honeywell Operating System (or HOS) for production, which integrated several management theories.

Honeywell PMT: Winning by Innovating

Environmental regulations in emerging markets such as China and India present a high-growth area for Honeywell and other companies with significant scale advantages to access.