First Data Corp

Latest First Data Corp News and Updates

Could Square Survive a Fiserv–First Data Tie-Up?

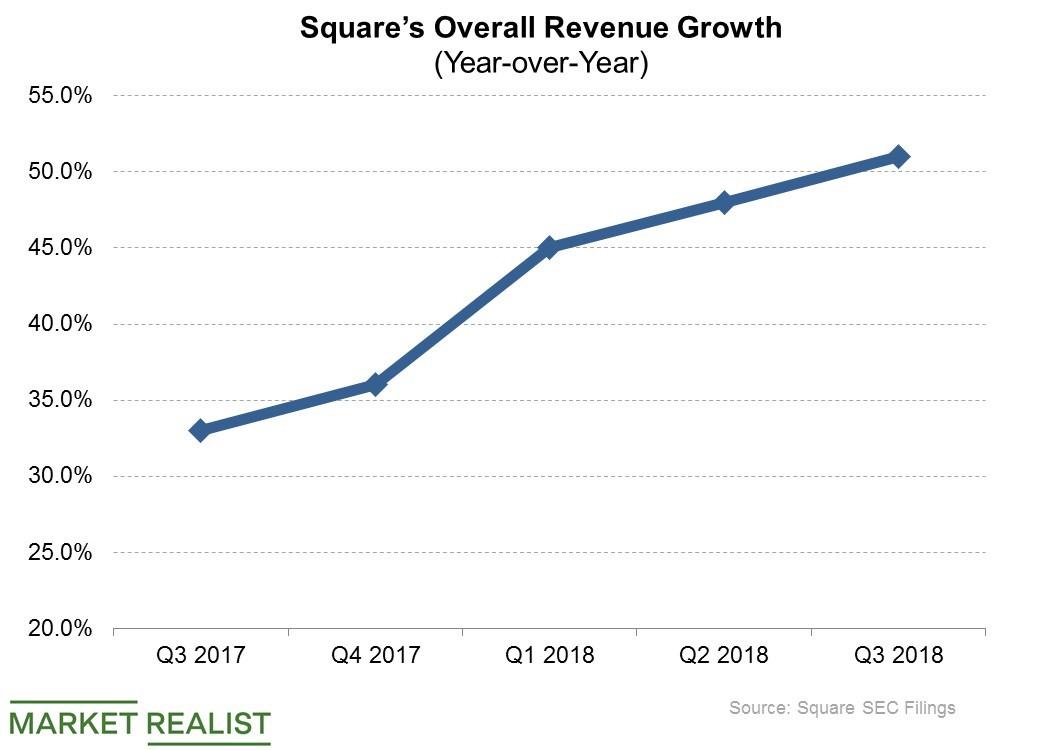

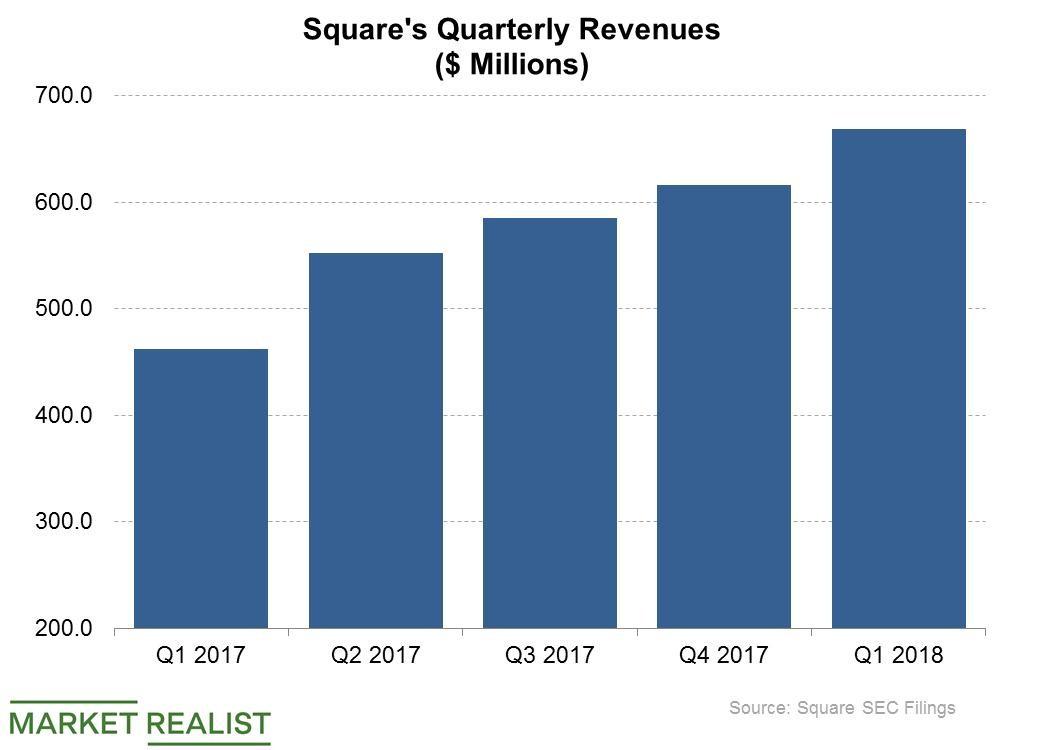

Fiserv (FISV) and First Data (FDC) have agreed to join forces in a $22 billion merger that is set to create a stronger competitor for Square (SQ) in payment processing.

Square: There Is More to the Cash App Than Meets the Eye

Square’s (SQ) money transfer service Cash App has expanded a great deal since it launched.Financials Investing in fixed income: What motivates bond investors?

We can understand the investment objectives of fixed income investors in terms of returns, risks, and constraints. There are two categories of investors.

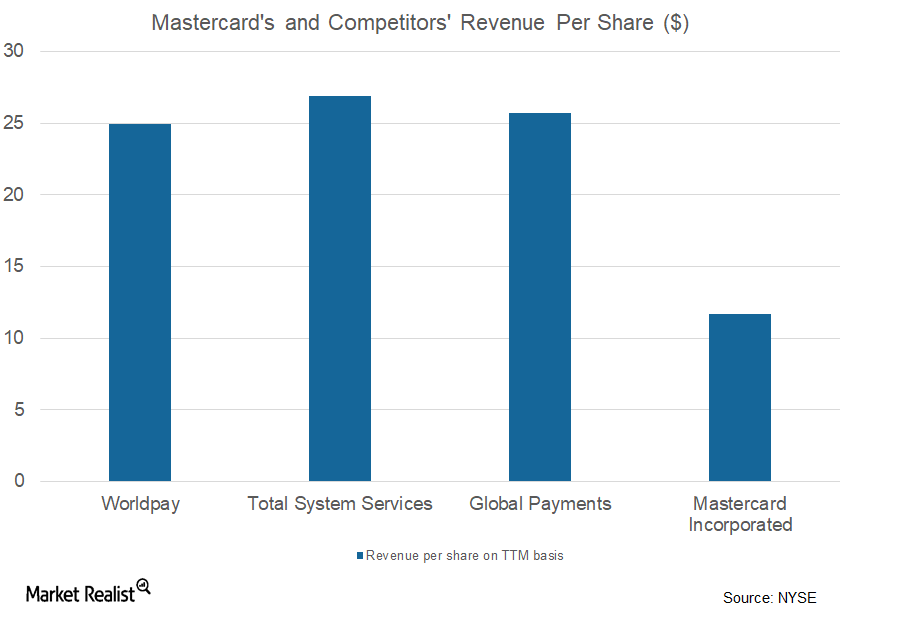

What Are Mastercard’s Growth Strategies?

Over the past few years, Mastercard’s (MA) revenues have remained consistent.