First Trust NYSE Arca Biotechnology Index Fund

Latest First Trust NYSE Arca Biotechnology Index Fund News and Updates

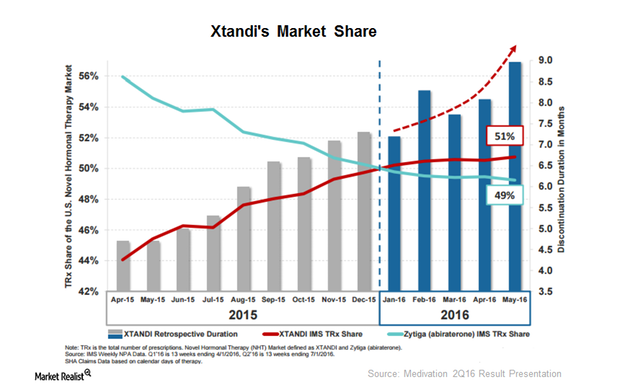

How Xtandi Fueled Big Pharmaceutical Interest in Medivation

Xtandi is the major factor behind Pfizer’s (PFE) interest in Medivation (MDVN). The drug, along with MDVN’s pipeline molecules, should strengthen Pfizer’s (PFE) oncology franchise.

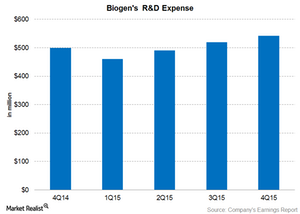

How Much Does Biogen Spend on Research and Development?

Biogen’s (BIIB) R&D expenses for 4Q15 were $542 million, or 19% of its total revenue, including a $60 million payment to Mitsubishi Tanabe.

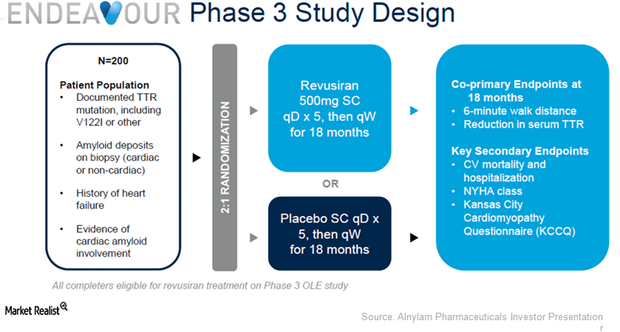

ALNY Should Complete Revusiran’s Endeavour Trial Enrollment in Late 2016

If the Endeavour study results in positive data, Alnylam Pharmaceuticals may become a major rare disease player like its peers United Therapeutics (UTHR) and Vertex Pharmaceuticals.

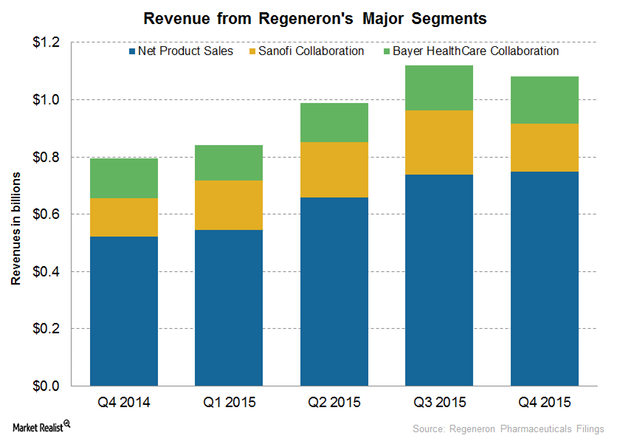

Regeneron Pharmaceuticals’ Major Revenue Sources in 4Q15

Regeneron Pharmaceuticals (REGN) earns revenue from net product sales, collaboration, and technology licenses.