Covanta Holding Corporation

Latest Covanta Holding Corporation News and Updates

An Overview of Covanta Holding’s Business Model

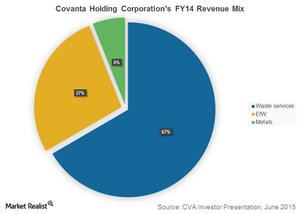

Covanta Holding Corporation (CVA) generates revenues through waste collection and services, energy from waste, and metal recycling.

What Happens to Waste? The Basics of Municipal Waste Management

In simple terms, municipal solid waste is trash or garbage discarded by households and commercial establishments.